Victoria’s Secret may be in decline, but the struggling brand still has plenty of life left in it, YouGov data shows.

The years-long decline of a brand that once defined female beauty for many American women can be attributed its well-documented disconnect from shifting attitudes following the #MeToo movement. However, the brand’s decline predates the movement and many suggest the brand has simply been too slow to adapt to changing consumer tastes.

But in a lot of respects, it’s still a sector leader.

Perception of quality among American women has slid over the last few years for the lingerie brand, however Victoria’s Secret is still well ahead of apparel sector averages, YouGov data suggests. Further, the brand also has higher-than-sector-average Recommend, Awareness and Purchase Intent scores (albeit all are showing declines as of late).

All this suggests the once darling of the runway may have enough runway of its own to turn things around. Sycamore Partners, which announced a majority share purchase in Victoria’s Secret from L Brands for $1.1 billion, hasn’t indicated what its plans are with the brand, though drastic changes could be expected.

“With unmatched global brand awareness and customer loyalty, we believe there is a significant opportunity to reinvigorate growth and improve the profitability of Victoria’s Secret. We look forward to partnering with the leadership team to pursue these objectives,” Stefan Kaluzny, Managing Director of Sycamore Partners stated in a press release announcing the sale.

Changing consumer tastes coupled with some high-profile missteps have taken a toll on the brand. The brand’s Buzz score -- a net score based on whether US adults have heard anything negative or positive about the brand -- has declined over the last several years, especially since the end of 2018.

Brand equity aside, real equity remains an issue for Victoria’s Secret: the company chalked up a 10 percent decline in same-store sales during the fourth quarter and a 12 percent dip in same-store sales during this past holiday season.

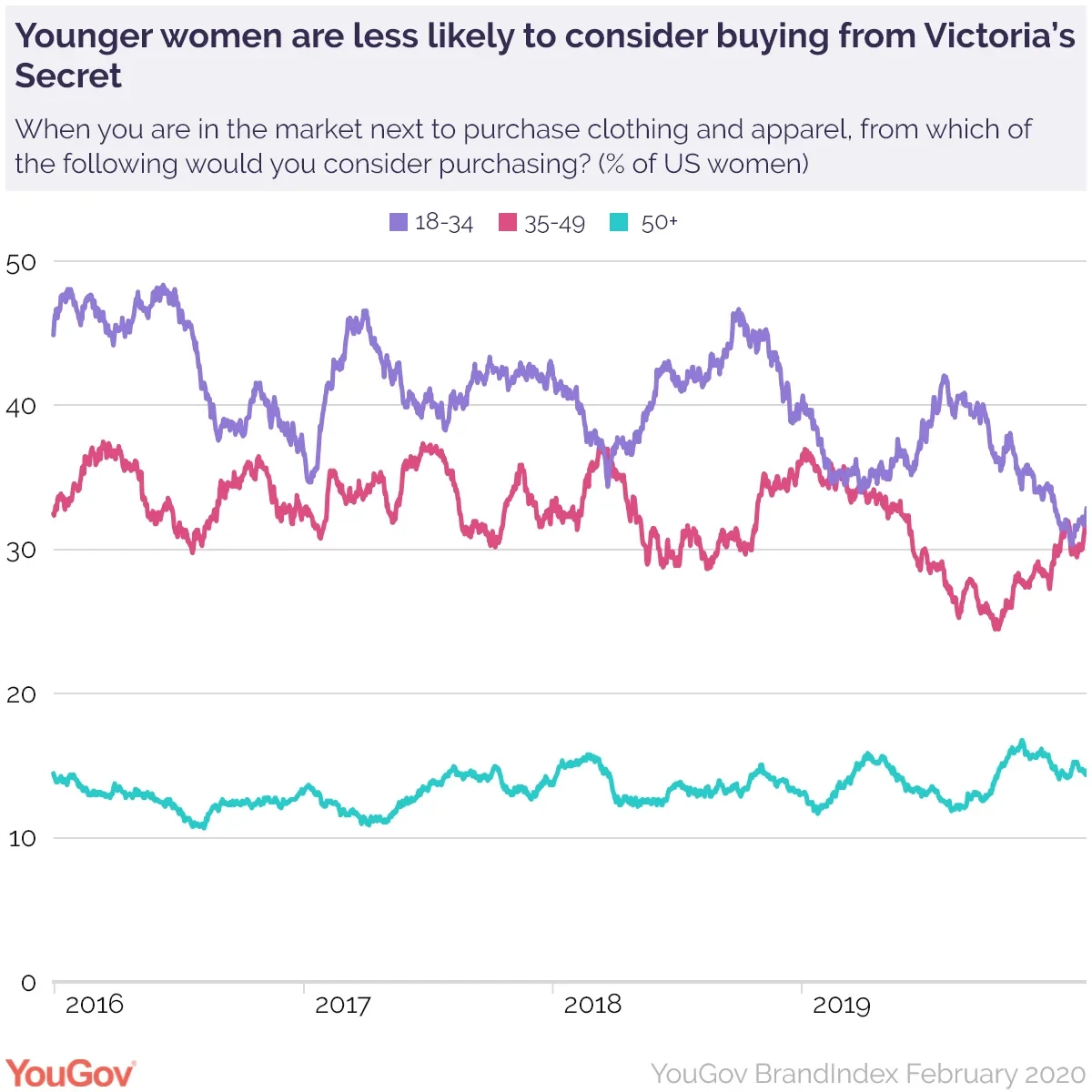

There’s no doubt the brand isn’t resonating with young Americans like it once did. YouGov data suggests the number of American women aged 18-34 considering a purchase from Victoria’s Secret has declined from a high of 49 percent in 2016 to 32 percent today. Consideration among US women aged 35-49 also slid, from a high of 37 percent to 30 percent today. Scores among those 50 and over remain steady.

Methodology: Buzz score is based on an average daily sample size of 671 US women aware of the Victoria’s Secret brand on a 12-week rolling average. Consideration score score is based on an average daily sample size of 985 US women aware of the Victoria’s Secret brand on a 12-week rolling average. Quality score score is based on an average daily sample size of 2,960 US women aware of the Victoria’s Secret brand on a 12-week rolling average.

Image: Getty