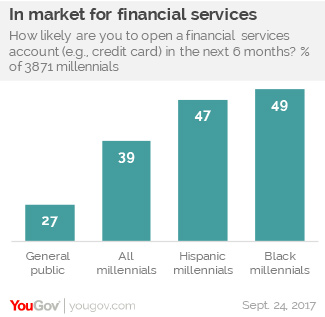

While positivity around consumer confidence is low, black and Hispanic millennials are the most likely seek financial services in the next six months (49%)

A New York Times analysis last year concluded that millennials aren’t signing up or using credit cards at nearly the same rate older Americans are. The report suggests that growing up in the midst of economic crises and watching their parents fall into financial trouble has made the younger generation wary of pulling out the plastic for purchases. Many young people also face an ever-growing mountain of student debt and a granular look at millennial data also reveals that not all young people can be considered equally.

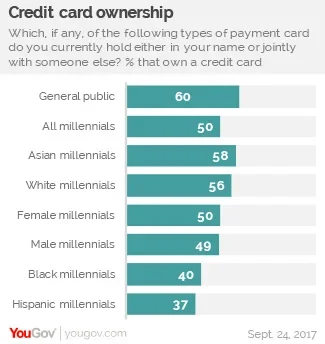

YouGov Profiles reveals that more Americans own a debit card (70%) than a credit card (60%). Setting a baseline is important when it comes to millennials, some of whom are just beginning to take on credit responsibility. On average, one in two millennials own a credit card (50%) and white and Asian millennials boast the highest rate of ownership (56% and 58% respectively). But that number drops for Hispanic millennials (37%) and black millennials (40%).

Regarding just how many cards millennials might be juggling, nearly one in three Asian millennials have at least one credit card and 38% have between two and five. White millennials trail closely with nearly a quarter owning one credit card and a third owning more than two. Black and Hispanic millennials are the least likely of millennials to have one card (17%) and just over a quarter own two or more credit cards (26%).

Black millennials are the most likely to have a pre-paid card (29%), while only 16% of millennials and 13% of the general public do the same.

YouGov polled millennial respondents to gauge  sentiment surrounding their finances. Under half say that they considered themselves financially secure (46%) and women under 35 were the least likely to say so (42%). Indeed, when asked compared to a month ago if they thought now was a better or worse time to make a major purchase like a car or vacation, more were like to say it was worse (23%) than better (12%).

sentiment surrounding their finances. Under half say that they considered themselves financially secure (46%) and women under 35 were the least likely to say so (42%). Indeed, when asked compared to a month ago if they thought now was a better or worse time to make a major purchase like a car or vacation, more were like to say it was worse (23%) than better (12%).

The future isn’t without hope for the credit economy though. YouGov consumership data shows that one in two black millennials will be in market for financial services such as opening a credit card at some point in the next few months (49%) and Hispanic millennials are like to say the same (47%).

Read the full results from this poll here

Find out more about YouGov Profiles here