While many millennials consider themselves financially secure, only half are ready for a personal financial crisis

TWITTER FOLLOW

An article first written by The Atlantic in 2013 is circulating around the internet again and its point regarding why so many Americans label themselves as “middle class” seems just as relevant now as it did four years ago. YouGov Profiles utilizes the latest data from thousands of middle-income Americans to identify the social construct surrounding “class” and offer an up-to-date look at what “middle-class” means for households across different generations.

The US Census Bureau doesn’t offer any hard definitions for “class” or a person’s relative status in society according to income, wealth, power, or position. For the sake of clarity, this article will discuss “middle-class” in terms of household economics and specifically middle-income households that earn between $40,000 and $120,000 a year in total income.

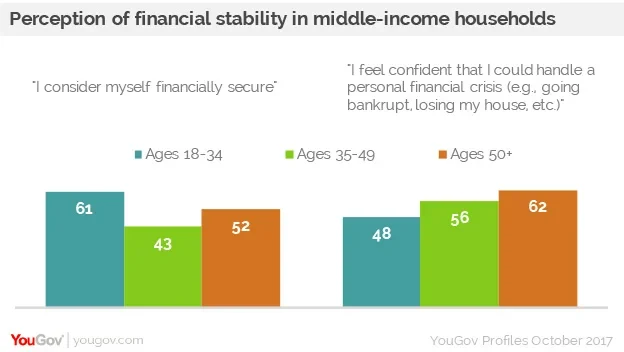

Looking at the attitudes around finances reveals that some age groups in this income bracket feel more financially stable than others. Less than half of Americans between the ages of 35-49 in the middle-income bracket consider themselves financially secure (43%) and more than half admit that they are not financially stable (51%). The financial pressure may stem from the fact that 59% of this group have children under 18 and 48% mortgage their homes.

While millennials may feel the most financially secure (61%), they are the least confident when it comes handling a sudden personal financial crisis (48%). This might explain why one in five millennials in this income bracket still live rent-free with their parents (20%) as a way to continue saving.

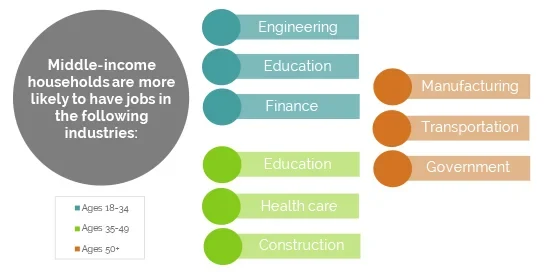

A close look at the industries that each age group works in illuminates how the middle-class has changed the way it earns money. Compared to the national representative, more middle-income Americans over the age of 50 work in the manufacturing, transportation and warehousing, and government sector. Members of Generation X tend to work in education, health care and social assistance, and construction compared to the general public, while more millennials have careers in engineering and computer-related design, education, and finance. The data shows a shift from traditional blue-collar jobs to careers that require soft-skills and higher education and marks the evolving middle-income household.