Just because someone is affluent, doesn’t mean they don’t stress about money. That stress could mean opportunity for financial services firms looking to win some new clients, according to data from the 2019 YouGov Affluent Perspective Global Study.

Each year, the Affluent Perspective asks more than 8,000 affluent people about their attitudes finances and financial services.

More than half (51%) of the Global affluent are worried about running out of money, according to the study.

Around 12 percent say that managing their personal assets is a stressful practice.

That group of financially stressed individuals show a higher level of concern about their money running out some day: 66 percent of them are worried about depleting their resources compared with 51% of the overall group. And it is entirely plausible this group could run dry of funds—37 percent agree that they are currently spending beyond their means.

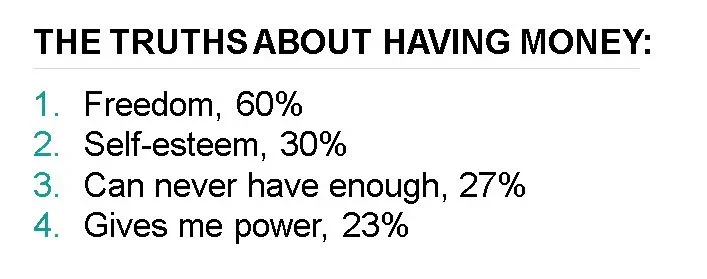

But having money means there is some freedom to make choices about how to manage those finances, and gaining the upper hand in their stress may involve finding a new way of doing things.

More than three quarters (78%) of the financially stressed are looking for new ways to invest and a quarter (25%) are interested in finding someone new to help manage their personal assets.

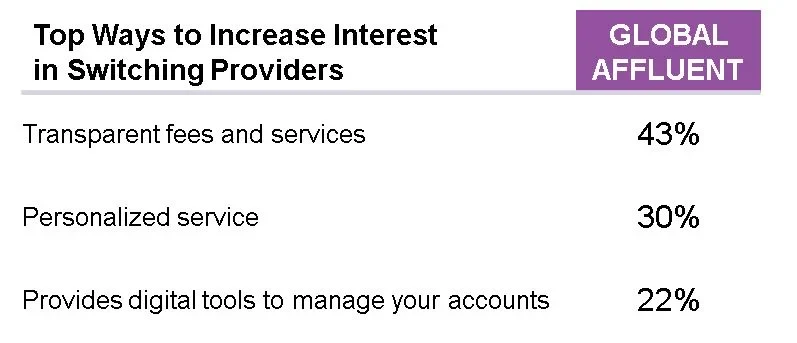

But this is a smart group, and convincing them to make the switch to a new financial services firm begins with having transparent fees and services. The financially stressed want to know exactly what they are getting.

Personalized service is also important. This group wants to be treated as more than just an account.

Finally, financial services firms looking to win over this group of people should be sure to provide digital tools for managing accounts.

This group is ultimately after a measure of self-sufficiency in managing the day-to-day aspects of their finances. Helping them understand these offerings will help them make the switch today.