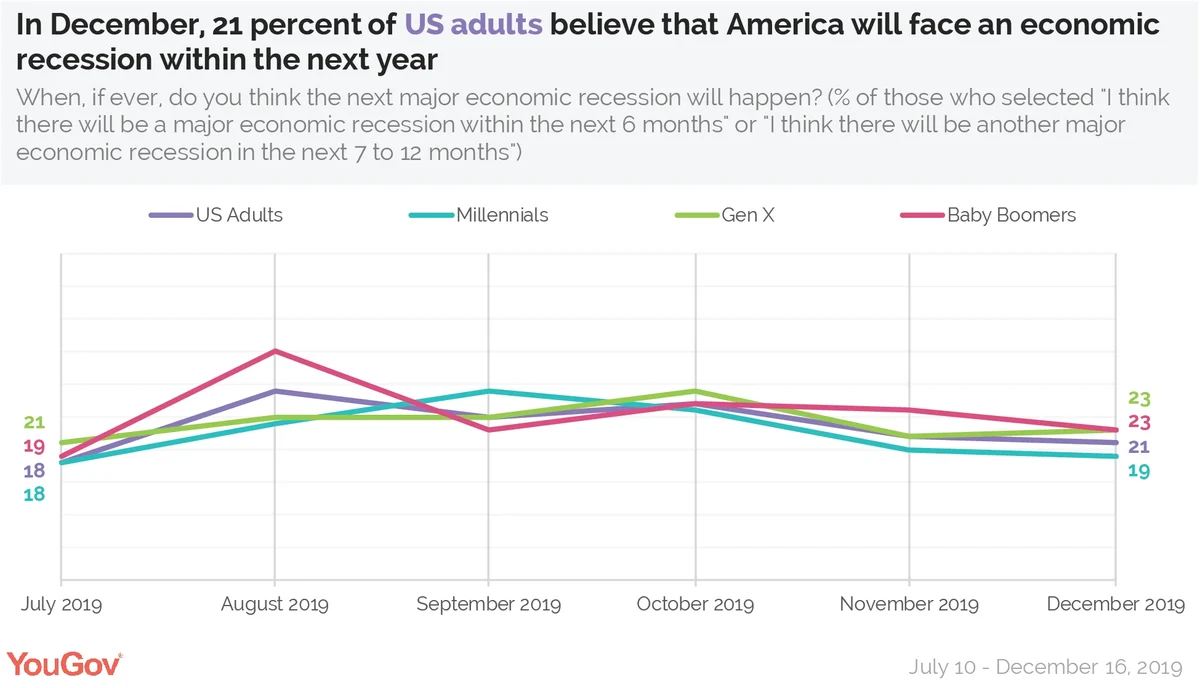

What happened to all that fear over an impending recession? It doesn’t seem to be a topline concern these days for most consumers, according to a YouGov survey from December of 1,266 US adults about the possibility of an impending recession.

Roughly two in 10 Americans (21%) believe a major economic recession will arrive within a year. That’s down from 25 percent in October and roughly even with 22 percent last month. Furthermore, fewer than four in 10 (36%) expect a recession in the next two years, which is down from 43 and 39 percent, respectively.

Democrats (31%) continue to be more worried than Republicans (8%) or Independents (25%) that a recession is a year or less away, but it’s worth noting that Democrats’ concerns are slightly down from last month (34%). Republican concerns are nearly unchanged from last month (9%), while Independents are more likely than last month (22%) to feel a recession is on the way.

Preparedness is still a concern

Maybe it was all the sales. In the wake of a record-setting Black Friday, Americans told us that they feel less prepared for a recession than in recent months. More than a third (37%) of US adults feel very or somewhat prepared for a recession if it were to come now. That’s down from 42 percent last month.

As seen in past months, Americans are more pessimistic when it comes to the country’s preparedness as a whole. More than six in 10 (62 percent, slightly up from 59 percent in November) feel the United States is not very or not at all prepared for a recession, with Baby Boomers especially pessimistic (70 percent, compared to 61 percent of Gen Xers and 57 percent of Millennials).

Holiday Spending

It may be that fears of a recession are falling, but economics still factor into household decisions, and many are taking action with their spending this holiday season.

Overall, roughly a third of Americans say their outlook on the US economy will hold a great deal of influence or some influence over their spending on gifts (32%), travel (30%) and entertaining (30%). Millennials are the most likely to say their views on the economy will likely impact their holiday spending across all three categories (42% gifts, 37% travel, 34% entertaining), followed by Gen Xers (35%, 33%, and 31%, respectively) and Boomers (32%, 28%, and 26%, respectively).

More than half of those who see a recession on the horizon (within the next year) say their outlook on the US economy will influence their spending on gifts during the holiday season (54%, vs. 31% of those who don’t feel a recession is on the way).

Similarly, 52 percent of those expecting a recession say their feelings on the economy will influence their spending on travel this holiday season (vs. 26% of those not expecting one) and 48% say it will influence their spending on entertaining (vs. 25%).

Presidential influence

So shopping is a concern, but what about politics?

A 40 percent plurality of Americans — albeit a diminished one compared to 46 percent last month — believe President Donald Trump’s economic policies are making a recession more likely. Fewer (29%) feel his policies are making a recession less likely.

Among registered voters, 45 percent believe the president’s policies are making a recession more likely (identical to last month) while 35 percent say less likely (nearly even with 36 percent last month). Partisan splits continue along similar lines: Nearly seven in 10 Democrats (68%, a drop from 72% last month and 78% as far back as September) say Trump’s policies are making a recession more likely, while nearly seven in 10 Republicans (67%, down slightly from 69% last month but still up markedly from 54% in October and 52% in September) believe his policies are making it less likely.

Independents continue to split the difference somewhat, with a two in five plurality (40%, identical to last month) saying that Trump’s economic policies are making a recession more likely. A growing minority (32%, up from 28% last month) indicate that his policies are making one less likely.

Look at YouGov’s economic trend data from December, November, October, and September.

Image: Getty