Most Americans say they've noticed the cost of housing in their communities increase over the past decade, as well as over the past year. Two-thirds of Americans say it's difficult to find affordable housing in their areas and a majority expect housing prices will continue to rise. It's a seller's market according to most Americans. While the largest share of people attributes housing costs to inflation, a majority also tie costs to large real-estate investors buying up houses and developers trying to maximize profits.

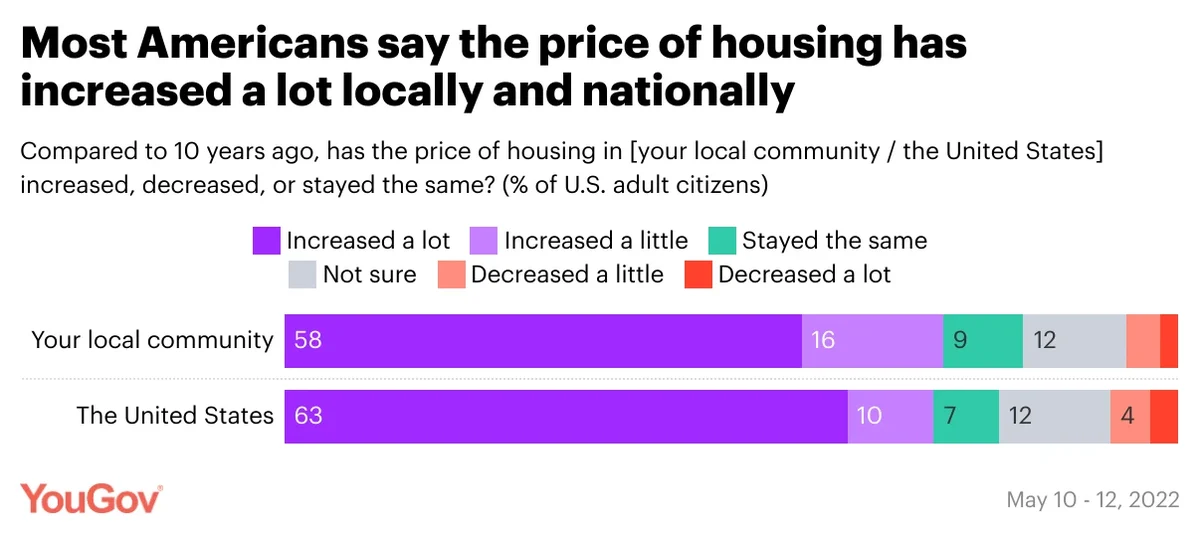

A recent YouGov poll asked Americans their opinions on housing in their local area as well as in the United States more broadly. Most Americans say that the price of housing has increased a lot locally over the past 10 years, and a majority says the same about national prices during that same period. Slightly more say prices have risen a lot nationally than say the same about their local area. Fewer than 10% of people say housing prices have decreased locally, and a similarly small share says the same about national prices. White Americans are nearly twice as likely as Black Americans to say the price of housing in their area has increased a lot in the past 10 years.

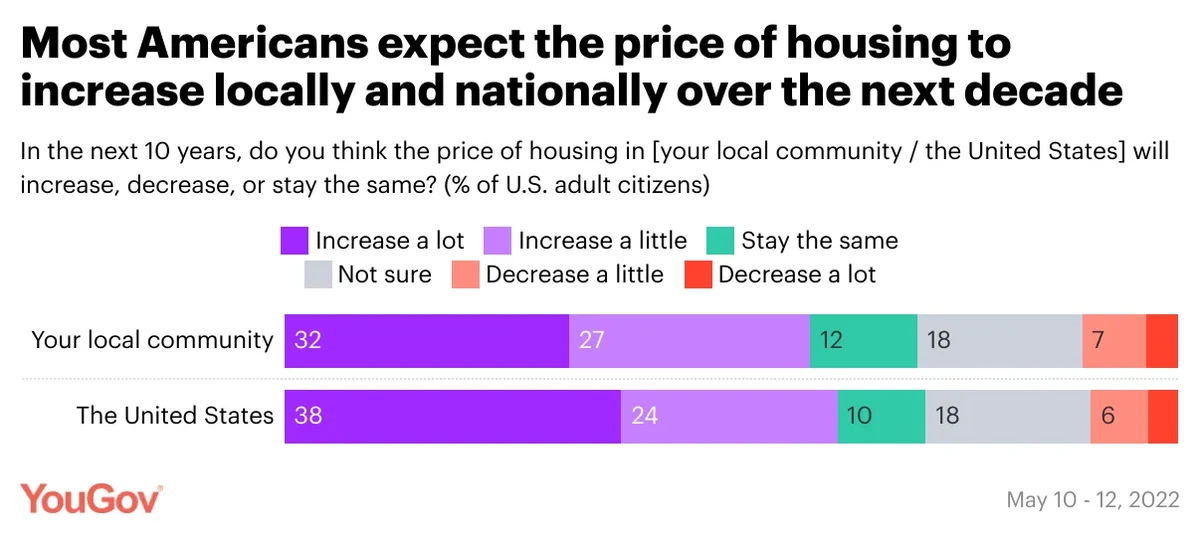

Over the next year, as well as the next 10 years, most people expect the price of housing in their communities and in the country as a whole to continue rising. Few say they expect prices to decrease over this period.

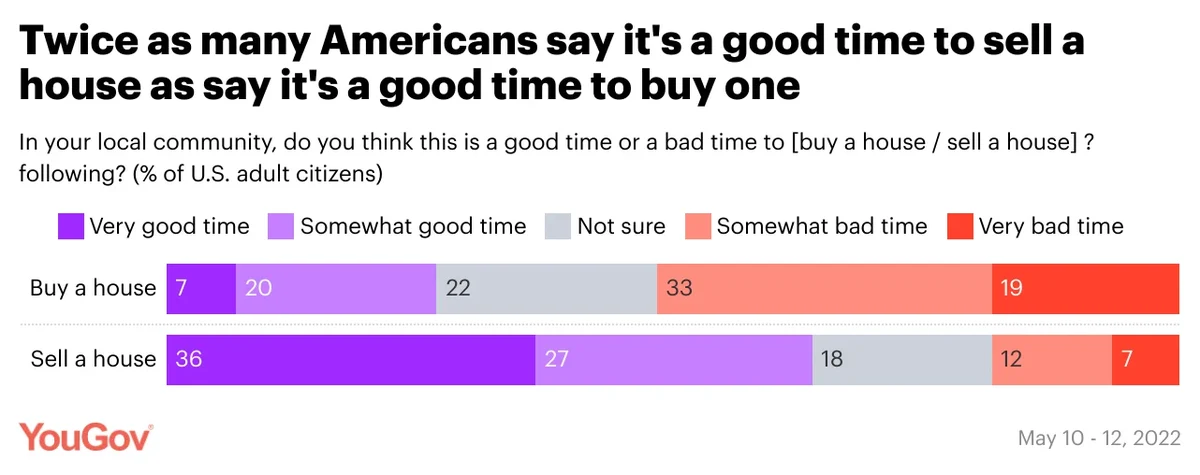

With housing costs reaching record highs in many places, Americans are far more likely to say it’s a good time to sell a house than to buy one. Nearly two in three say it’s a good time to be selling a house while half as many say the same about buying a house.

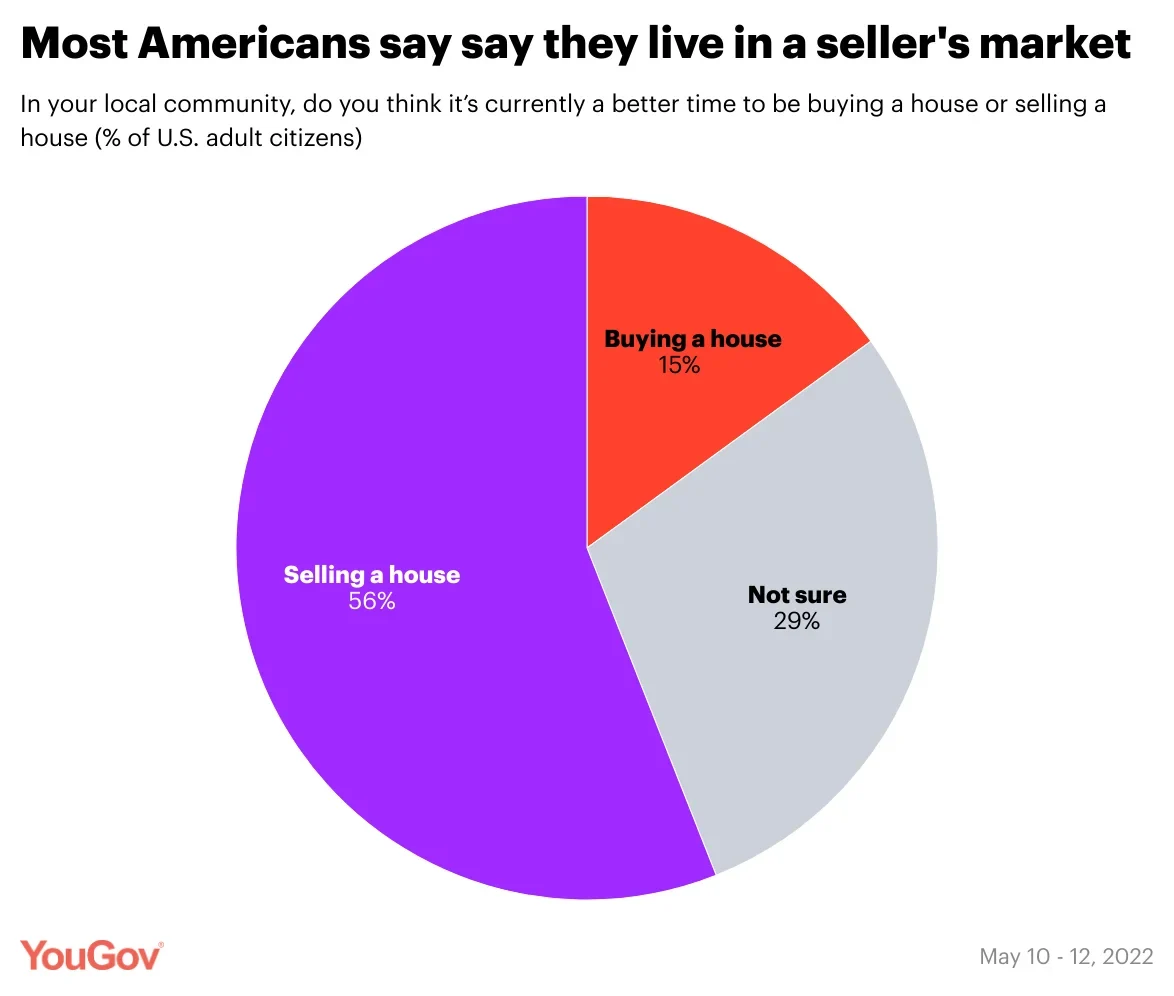

When asked directly which it’s a better time for, 56% say it’s a better time to sell while only 15% say it’s a better time to buy.

Despite data showing that the supply of entry-level housing in U.S. is near a five-decade low, about half of Americans say the number of homes being built in their community has increased over the past 10 years, while only 16% say it has decreased. Though many say homebuilding has increased, a large share also believe housing remains in short supply. Around half of Americans say that housing supply has not kept up with population growth, and nearly two-thirds believe that wages have not kept up with the price of housing.

Two-thirds of Americans (67%) say it’s somewhat or very difficult to find affordable housing in their communities. Only 17% say it’s very or somewhat easy. Nearly half say they personally know someone who had problems paying or was unable to pay their rent or mortgage over the past year. Compared to white Americans, Black Americans are 10 percentage points more likely to say they know someone who has struggled to pay for housing.

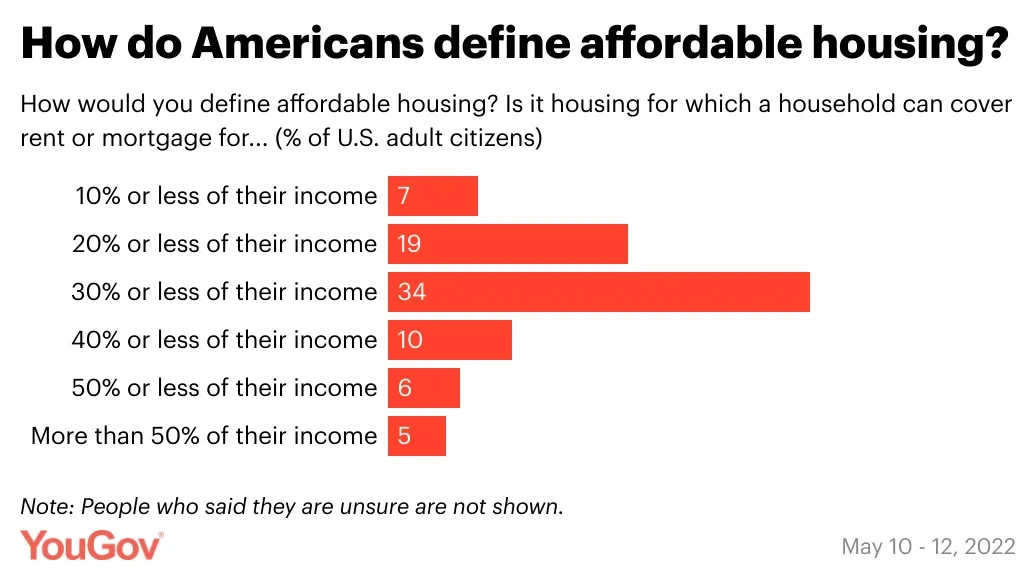

How do Americans consider affordable housing? Consistent with how the government and other groups often define affordable housing, most Americans define it as housing for which a household can cover rent or mortgage for 30% or less of their income, when given options ranging from 10% or less up to more than 50%.

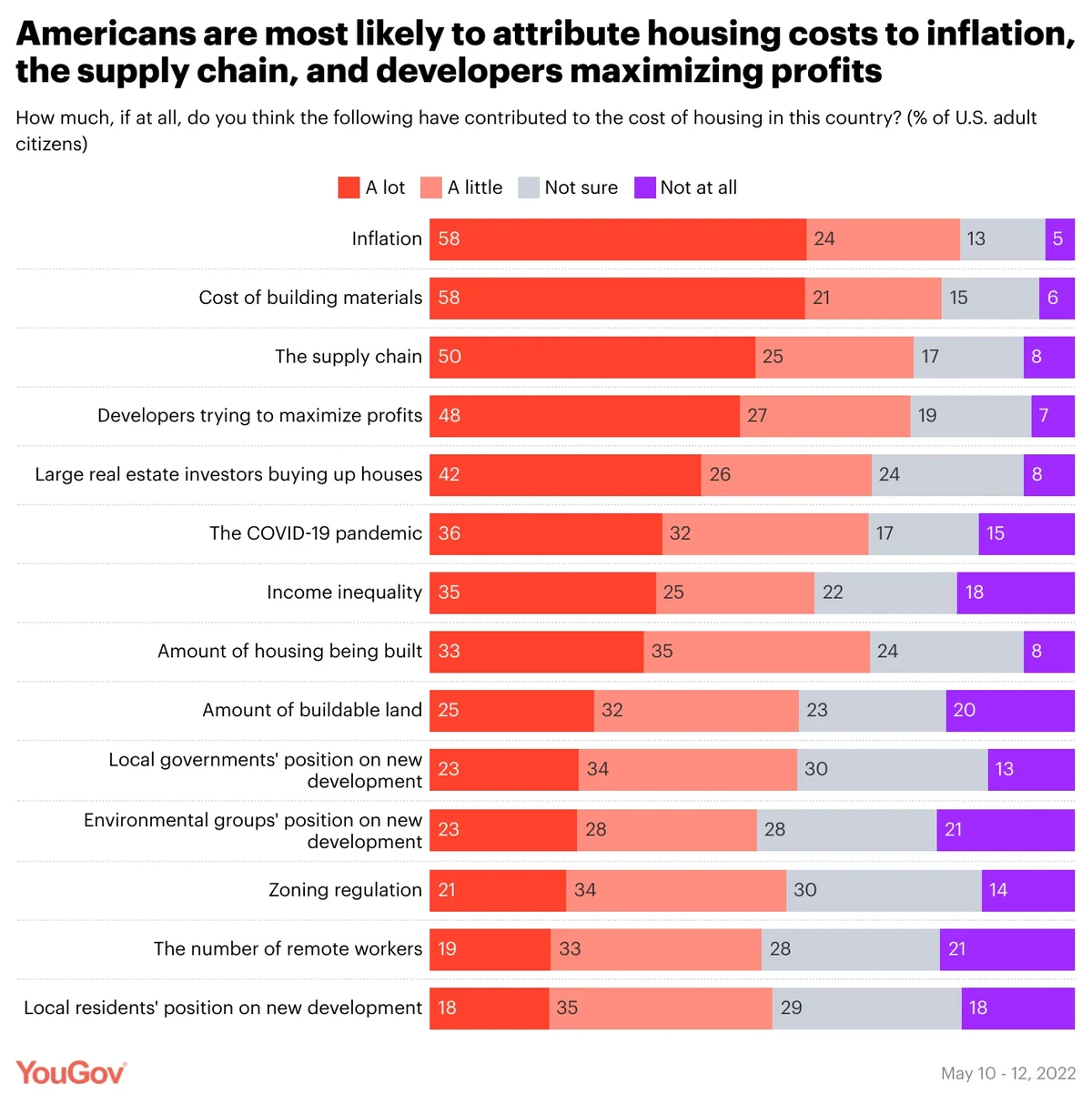

What has contributed to the cost of housing in this country? Most say inflation and the cost of building materials. A large share also say developers trying to maximize profits and large real-estate investors buying up houses. Fewer blame environmental groups, the number of remote workers, or the amount of buildable land.

Americans are three times as likely to say it's a “bad thing” rather than a “good thing” for corporate real-estate investors to buy up houses and turn them into rental properties. A majority of people say they would support legislation that created barriers for investors to buy up houses.

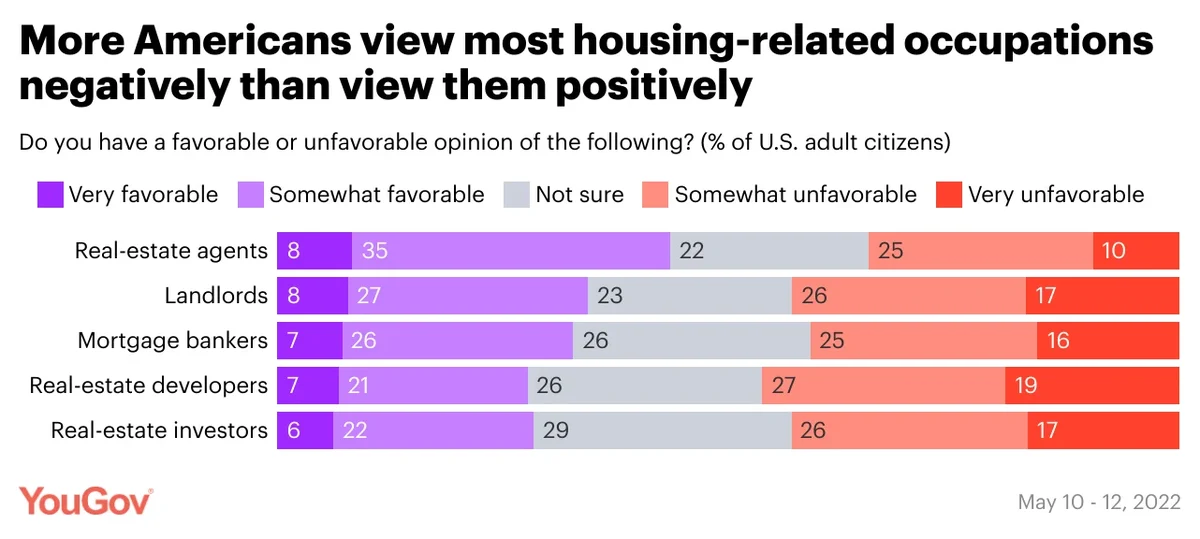

In general, most people hold negative views of people working in occupations associated with housing and development. The only occupation polled about that more Americans hold favorable than unfavorable views about is real-estate agents. The other four occupations in the poll – real-estate developers, real-estate investors, landlords, and mortgage bankers – received net negative favorability scores.

— Carl Bialik and Linley Sanders contributed to this article.

Related:

- One-third of first-time American homebuyers got financial help from their parents

- Most Americans say discriminatory redlining occurs often in the U.S.

- Most Americans support policies that increase renters’ rights

- Who do Americans blame for homelessness?

This poll was conducted on May 10 - 12, 2022, among 1,000 U.S. adult citizens. Explore more on the methodology and data for this U.S. News Poll.

Image: Liz Sanchez-Vegas on Unsplash