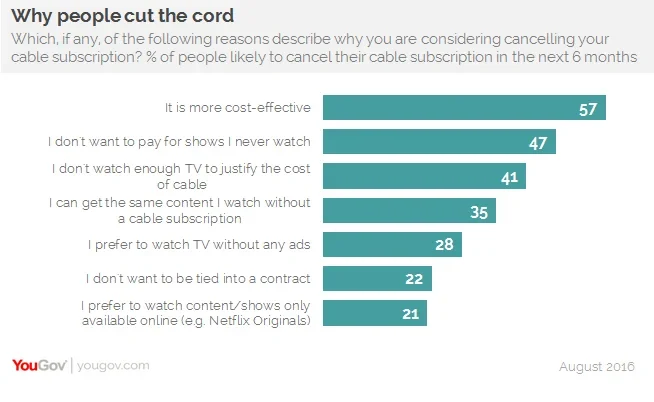

New data reveals that 57% of people likely to cancel their cable subscription want to save money, while only 28% want to avoid the ads

As we noted recently, data from YouGov Profiles suggests that the act of moving from one home to another can provide people tempted to cancel their cable subscription with the perfect opportunity to do so. "Whether it was a month, six months, or three years ago, the pattern remains the same," we wrote. "People who have recently moved are more likely to get by without cable."

While relocating to a new neighborhood or city tends to be a major factor in pushing people over the edge, new data from YouGov Profiles reveals the steps that lead people to that edge.

57% of people both considering cancelling their cable subscription and likely to do so sometime in the next six months, for example, think that turning their back on traditional cable is more cost-effective. 47% don't want to pay for shows they never watch, while 41% say they don't watch enough television to justify the cost. Other reasons for cutting the cord include a dislike of conventional advertising and better selection of shows on streaming services, such as Netflix.

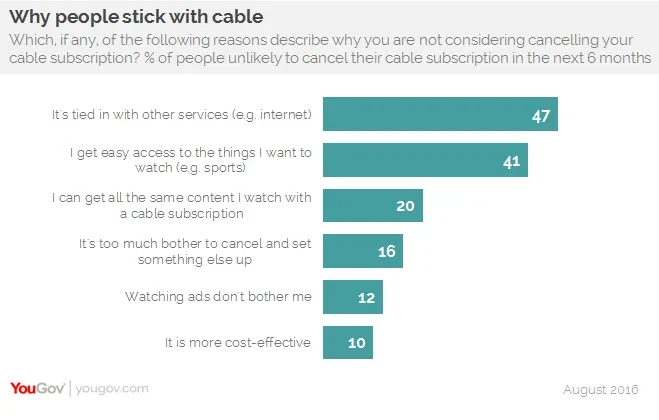

On the other hand, some people tempted to cancel their cable subscription ultimately decide to stay. For these folks, who've considered cutting the cord, but decided against it, and say they're unlikely to abandon their cable package in the next six months, 47% won't leave because it's tied to other services, such as the internet. 41% enjoy the hassle-free access to content they want to watch, while 16% can't be bothered with the work involved in making the switch.

Overall, a third of people with cable indicate that they've considered cancelling their subscription in the past, and are still contemplating it now. Of this group, 50% say they're likely to cancel in the next six months. At the same time, 35% of cable subscribers have never considered ending their subscription, and 17% say that though they've thought about it, they've decided to stay.

Just last week, Time Warner paid $583 million for a 10% stake in the popular streaming service Hulu. At the same time, Hulu has announced plans to end its free-to-view ad-supported model in favor of paid subscriptions. In other words, media giants are merging with new platforms, and new platforms are experimenting with various revenue models, as the TV industry tries to anticipate the changing habits and preferences of American viewers. Hard data, however, shows the multiple reasons why people decide to stay with their cable provider — or not.