Seven insights into the lives of Americans who “definitely disagree” they feel financially secure

Charting a path to financial security can be a daunting task for many. New research into perceptions of financial security—specifically that of Americans who feel financially insecure—reveals that examining financial habits alone cannot account for a holistic understanding of the issue. To fill that gap, YouGov’s latest report, Perceptions of financial security, compares views of the financially insecure and that of the typical American.

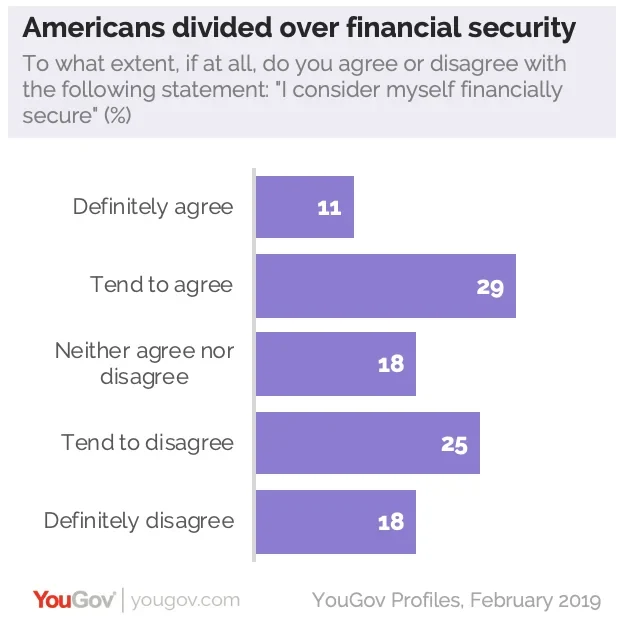

In the United States today, Americans

are conflicted about their financial well-being. When asked if they would consider themselves financially secure, 40 percent did and 43 percent did not. A closer look shows that nearly one in five (18%) Americans “definitely disagree” they feel financially secure.

Below are seven insights—from their attitudes toward retirement to their assessments of their health—into the lives of the 18 percent who feel the

acute pressures of financial security.

1. There are both short- and long-term financial concerns

Americans who “definitely disagree”

that they are financially secure have a host of financial worries. This includes the thought of being adequately prepared for a personal financial crisis. When asked if they felt confident they could handle a financial crisis, such as going bankrupt or losing their home, 71 percent of this financially insecure group disagreed (compared with 41% of Americans).

they are financially secure have a host of financial worries. This includes the thought of being adequately prepared for a personal financial crisis. When asked if they felt confident they could handle a financial crisis, such as going bankrupt or losing their home, 71 percent of this financially insecure group disagreed (compared with 41% of Americans).

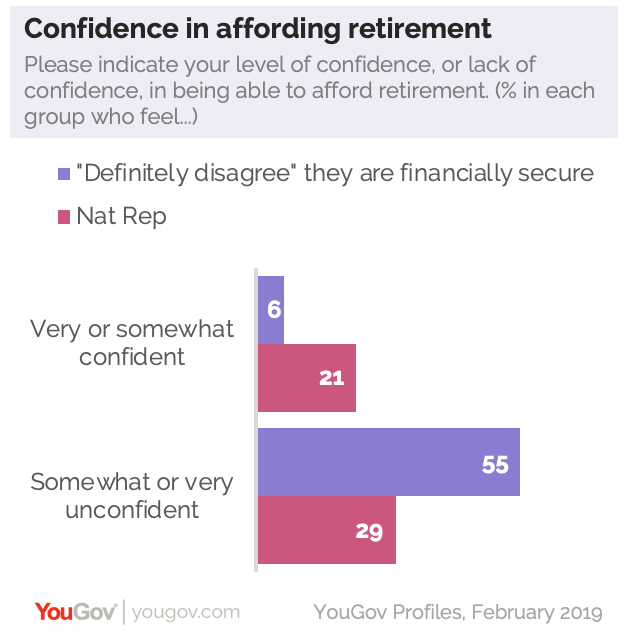

The same group also expresses little confidence in achieving a long-term goal: retirement. More than half (55%) say they are “somewhat” or “very” unconfident they will be able to afford retirement.

2. Financial insecurity has negative emotional effects

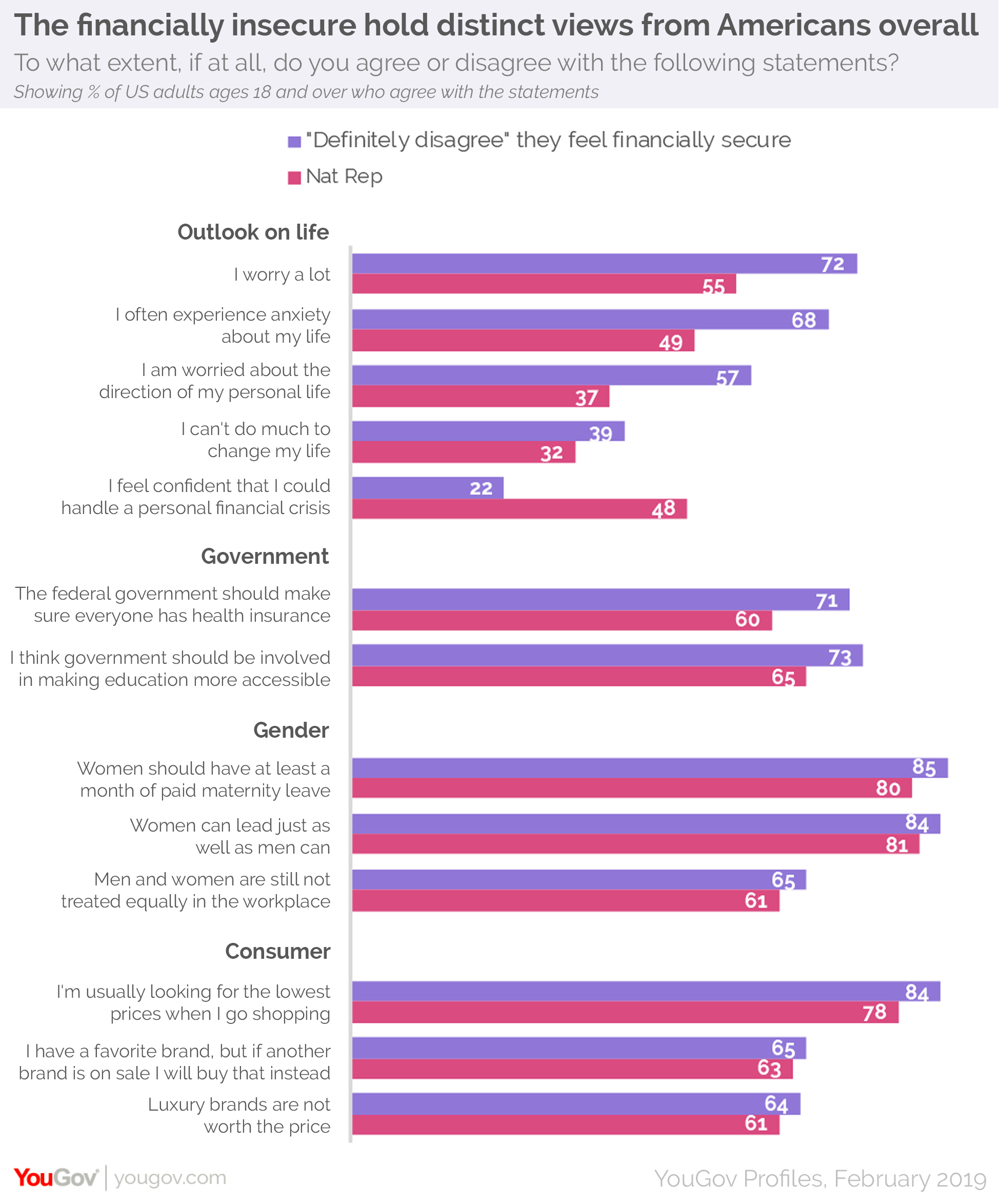

The data shows there are negative emotional effects to feeling financially insecure. Compared with the general population, the financially insecure are more likely to agree that they worry a lot (72%), with many expressing concern over the direction of their personal (57%) and professional (45%) lives.

Some of this worrying may translate into anxiety, with 68 percent of financially insecure Americans saying they experience anxiety about their lives. This suggests that managing feelings of financial insecurity involves more than just addressing financial habits. It requires a consideration for the emotional consequences of feeling financially insecure.

3. The future is a troublesome topic

Three in five (60%) in this group agree that they don’t like to plan too far in the future (vs. 50% of Americans). Nearly two in five (39%) say they can’t do much to change their lives (vs. 32% of Americans).

4. Financial insecurity can impact physical health

Seven in ten (71%) Americans who say they are financially insecure agree that they do not look after their health as much as they should. Across other measures of their diets and well-being, it is clear that taking care of their health is not top-of-mind for the financially insecure. For example, when asked to rate their personal health, individuals in the group were more likely to say their health is “fair” (39%) or “poor” (26%) (vs. 23% and 4% of Americans, respectively).

When asked how important healthy eating is to them, the financially insecure were more likely to fall somewhere in the middle, with just over a quarter (26%) saying it’s neither important nor unimportant (vs. 20% of Americans).

5. They think the government should ensure access to healthcare and education

Individuals who “definitely” feel financially insecure are more likely to say the government should make sure everyone has health insurance (71% vs. 60% of Americans). They also think the government should make education more accessible, with 73% agreeing compared with 65% of Americans overall.

6. They want equality and empowerment for women

Gender issues such as workplace equality and paid maternity leave are important topics to those who feel financially insecure. This group is more likely than the general population overall to agree that men and women are still not treated equally in the workplace (65% vs. 61% of Nat Rep), that new mothers should have at least a month of paid maternity leave (85% vs. 80%), and that women can lead just as well as men (84% vs. 81%).

Why do individuals in this group hold such strong opinions on gender issues? Of those who “definitely disagree” to feeling financially secure, 58 percent are women, making the issues all the more relevant.

7. They seek out discounts, sales, and offers more often

Examining this group’s attitudes toward purchasing reveals that they tend to hunt for deals. Individuals who feel financially insecure are more likely to agree that they look for the lowest prices while shopping (84% vs. 78% of Nat Rep), and are always on the lookout for special offers (88% vs. 85%).

What is particularly telling is their emphasis on getting the right price over staying loyal to a brand. Around two thirds (65%) say that if another brand is on sale, they will buy that over their favorite brand. And many agree that luxury brands are not worth the price at all (64% vs. 61% of Nat Rep).

Download the full report for free here

Methodology: The total unweighted sample size for this study includes 24,070 US adults ages 18 and over who answered the question, “To what extent do you agree or disagree with the following statement: “I consider myself financially secure.” YouGov Profiles uses digital tracking technology and daily online surveys to collect a variety of opinions, attitudes, and behaviors. All interviews were conducted online.

Photo: Getty