Others are saving for travel instead

Today, the average age of retirement for Americans is around 63 years old and with life expectancy higher than ever, saving for retirement is a major concern for workers. A new study from YouGov Omnibus explores the way American workers approach saving money.

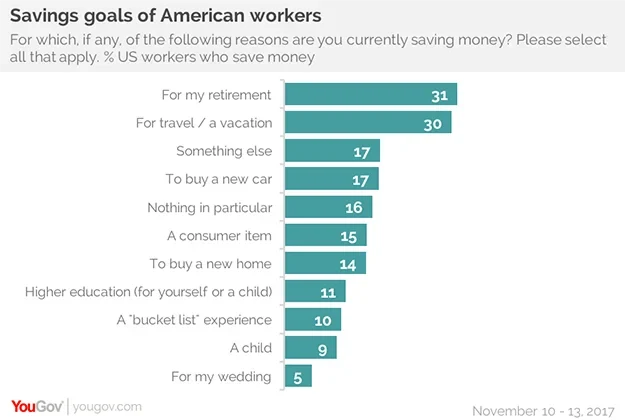

Respondents who said they are working and currently saving money were asked what reasons they had for setting aside a portion of their paychecks. The most popular response was retirement, with 31% of respondents saying this was a goal. Not far behind was travel, with 30% of respondents. Only 5% said they were saving for their wedding and only 9% for a child.

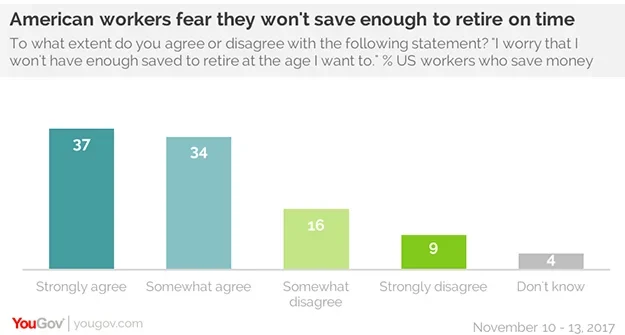

While funding for retirement is a primary concern among those saving money, this also represents an area of concern for many workers. When asked to what degree respondents agreed that they worry they won’t have enough money saved to retire at the age they want to, a total of 71% agreed – 37% of them strongly so.

For complete results, read the full report here.