All signs indicate that electric vehicles will rule the roads in the years to come as governments develop pathways to boost EV adoption. But traditional fuel vehicles currently dominate the automotive market, and our data suggests that might remain the case in the near future too. As long as fossil fuels remain the main source of power of passenger vehicles, the question of fuel efficiency in the context of engine power will remain an important one for both car makers and consumers.

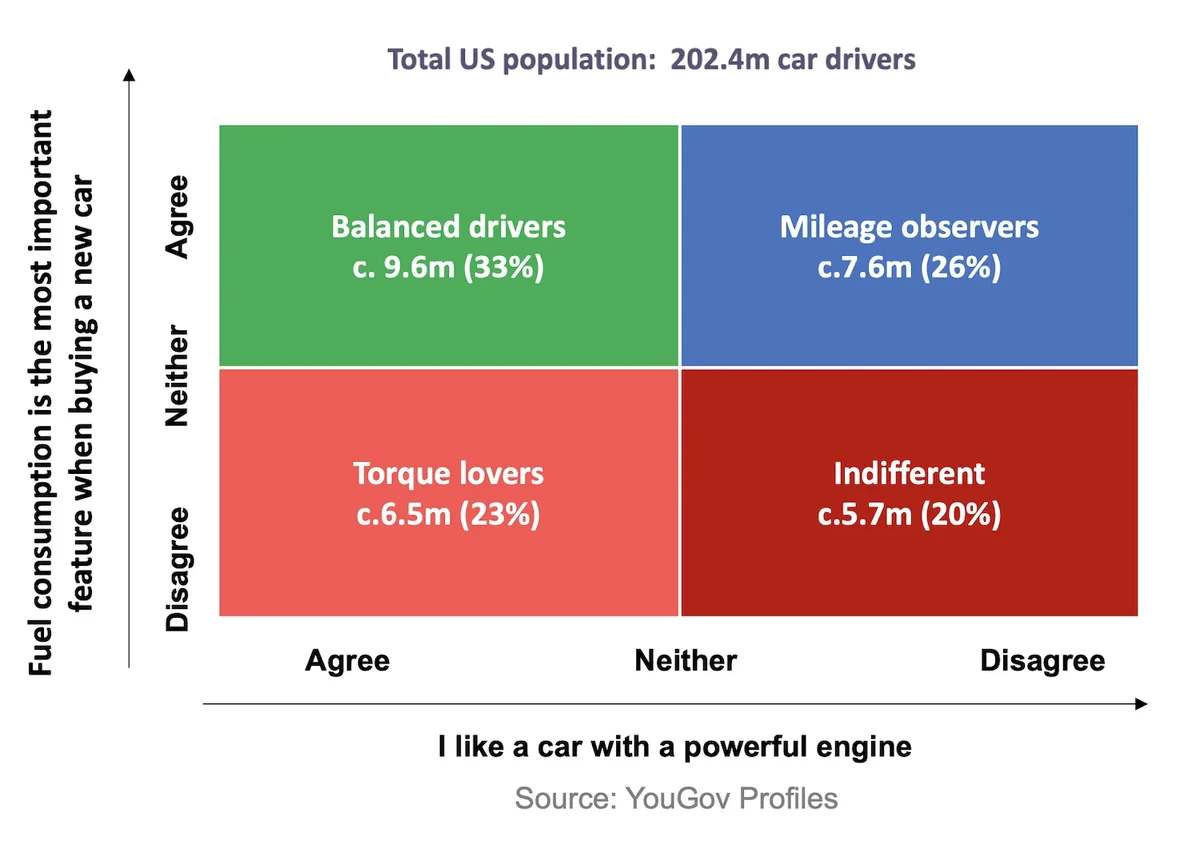

A new YouGov framework study, which draws on data from YouGov Profiles, segments and analyzes American car-drivers based on the emphasis they place on fuel efficiency and/or engine power in cars. Before we get into the analysis, let us quickly define each consumer category.

Balanced Drivers: This group places an emphasis on both fuel efficiency and engine power, representing one-third (33%) of all American car-drivers.

Mileage Observers: About a quarter of all US car-drivers (26%) consider fuel consumption to be the most important factor in car purchase and are indifferent to wanting a powerful engine.

Torque Lovers: This group appreciates the engine power irrespective of its mileage. About a quarter of car drivers in the US (23%) prefer vehicles with a powerful engine but do not necessarily consider fuel consumption as an important factor in a new car.

Indifferent: This group, representing a fifth of car drivers in the US (20%), is indifferent to either fuel consumption or engine power and has not been profiled.

Balanced Drivers

Two in five Balanced Drivers – who consider mileage an important factor but also like powerful engines – are aged between 25 and 44 (41%), as against 34% of all US adults. They are significantly likelier than the national population to self-identify as having the sole responsibility for buying cars (50% vs 37%).

Interestingly, Balanced Drivers exhibit a far stronger affinity to American-produced vehicles. Almost half of them (46%) say they buy cars only made in their country (vs 31%).

Mileage Observers

A quarter of car drivers in the US fall into the Mileage Observers category (26%). This category features an older demographic skew, with almost one in two consumers aged over 55 (46%, vs 36% nationally).

Consumers in this group tend to be price sensitive. More than seven in ten (72%) say they look at the overall price when choosing to buy a car, compared to 61% of all US adults. Additionally, 87% say they always check whether a basic version of a car meets their needs compared to 80% of the national population.

Torque Lovers

Torque Lovers make up just under a quarter of all American car drivers (23%) and again represent an older demographic with more than half of them aged over 55 (vs 37%). One quarter of them are retired compared to 17% of consumers nationally. Members of this group are less inclined than others to move away from traditional fuel. Six out of ten (61%) say they will consider a petrol engine when buying their next vehicle compared to 41% of all US adults.

This group has a strong inclination towards DIY when it comes to car care. For instance, half of them (50%) have cleaned the exteriors of their vehicle compared to just 28% of all US adults. Torque Lovers are also twice as likely to have replaced their car’s filters themselves (42% vs 21%).

Download the full framework and segment profiles

Contact us to learn more about how YouGov Profiles data could help you