Despite the challenges that travelers faced due to restrictions brought on by COVID-19, Americans appear eager to travel as they look forward to the rest of 2021. A closer look at travel interest throughout last year shows promising signs for travel recovery – mainly that Americans’ love for travel has not dampened at all compared to 2019 – but YouGov data also points to other reasons to be hopeful for a rebound.

1. Americans were just as interested in travel in 2020 as they were the year before

Not only do Americans look forward to traveling over the coming months, their engagement in travel compared to other interests stayed at pre-pandemic levels throughout 2020. Travel continues to be the seventh most popular general interest among Americans, only slightly behind the likes of Animals & Nature, Food & Beverage, and Politics. This holds true across all age groups, none of which show significant decay in travel interest over the last two years.

2. Americans continue to seek out travel content and information

Due to travel barriers and a lack of clarity about when it will be possible or safe pack our bags again, we’re seeing big drops in online visits to travel planning and booking websites. But not all mediums for travel content suffered in 2020 and the data points to boons in viewership for TV networks such as Travel Channel and National Geographic.

For example, when Americans were asked which TV networks they watched in the past 30 days, viewership for the Travel Channel increased by more than a third (35%) when comparing the month of November in 2019 (5%) to the same period in 2020 (7%). The largest increase in Travel Channel viewership occurs among younger Americans aged 18-34 (2% in 2019 vs. 4% in 2020; a 68% increase).

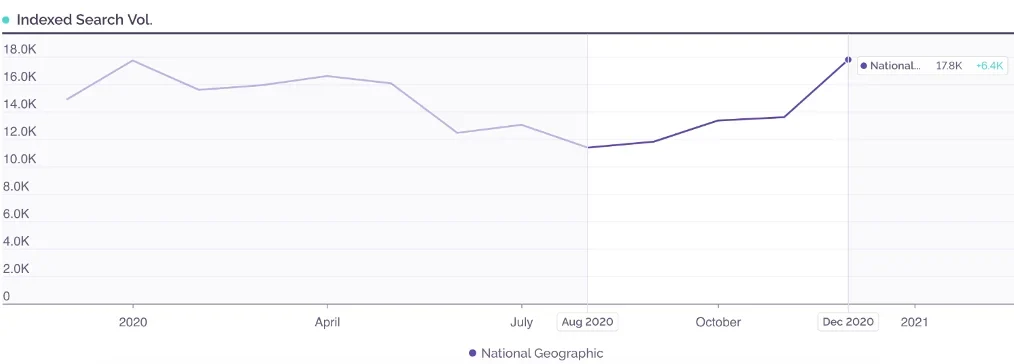

Data from YouGov Signal – a social listening tool that monitors sentiment and conversations around social media, news, and search – shows that online searches for National Geographic rose on average by 6,400 searches per day since August and the brand’s online search volume now sits at pre-pandemic levels. And throughout much of 2020, Twitter engagement with National Geographic also steadily grew – eventually peaking at roughly 1,000 engagements on average per day by August.

3. Relationships with travel brands remain strong

Even after the travel limitations which 2020 brought, American consumers continue to sustain their ties with travel brands. Data from YouGov’s daily brand tracker, BrandIndex, reveals that certain travel categories such as hotels, domestic airlines, and rental cars see only marginal decreases in four key consumer perceptions between February to November 2020 compared to the same period in 2019.

- Awareness – which measures whether or not people have heard of a brand – is holding steady across most major categories including hotels, domestic airlines, rental cars, online travel brands, cruise lines, and amusement parks.

- Purchase Consideration is down slightly for domestic airlines and amusement parks (both of which suffer four-point declines), and rental cars (one-point decline). The odd sector out is cruise lines, which see a double-digit drop. Hotels are the only category to see an increase of any kind -by two points.

- Shares of Current Customers in each travel category are also down compared to those recorded in 2019, which is expected with the decline in travelers. However, we’re seeing bigger drops in actual travel volume than is shown by decreases in current customers, suggesting that there are non-active travelers who continue to see themselves as active customers of travel brands.

- Purchase Intent is only slightly down in categories such as hotels, domestic airlines, and online travel brands. International airlines and cruise lines, which were impacted disproportionally by travel restrictions, see double digit declines in this measure.

What can travel brands do right now?

It’s been a hard year for the travel industry, and a lot of marketing activity has been put on pause while it waits for travel demand to return. Vaccine approvals and their eventual distribution to the general public signal an end to the pause on travel and a return to active planning and traveling. Now is a critical time for reinvigorating connections with consumers and for preparing for the resurgence of demand.

In 2021, travel brands have one chance to be part of a consumer’s amazing, magical first trip after more than a year of being grounded at home – the stakes for positive brand experiences that earn loyalty are likely to be higher than ever before.

Image: Getty