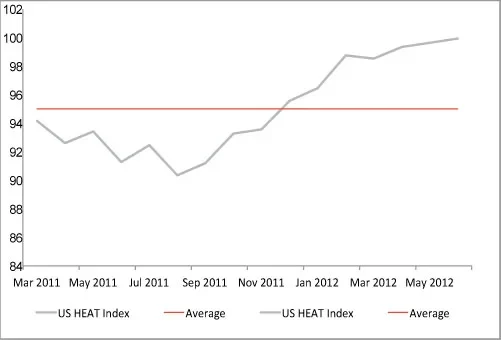

YouGov’s headline Household Economic Activity Tracker (HEAT) index slipped slightly from 100 to 98, as U.S. households report a softening of economic activity in July. While this change pushes the index back below the 100 line that is considered neutral, it is still above the average reading of the last 17 months.

CHART 1: US HEAT Index (100 = Neutral)

- The majority of respondents (65%) report that their household finances are unchanged from June, while around a quarter say their finances have become worse.

- When asked about the future, three-quarters of respondents do not anticipate further deterioration in their financial position.

- Though households are not wildly optimistic about their finances over the next year, it is encouraging that future consumer optimism has held up relatively well.

As manifested in last Friday’s release of the monthly payrolls report, we would highlight that the vast majority of working respondents say their sense of job security is either unchanged since the last month (71%) or even improved (10%). Yet there are 19% who feel more anxious about their working situation – a figure consistent with August of last year. 60% of working respondents say it is “unlikely” that they will be let go from their job in the next year.

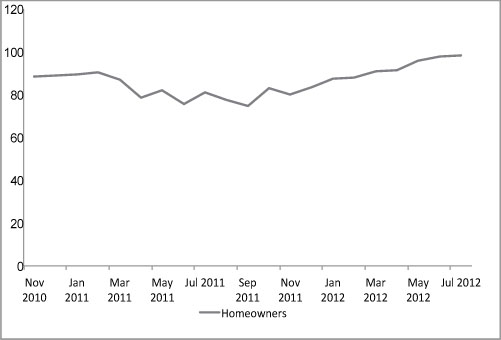

Housing represents a bright spot in the survey. The emerging consensus view that the housing market has bottomed reflects what HEAT respondents have been saying for at least six months. While homeowners are not yet reporting a perceived rise in the value of their home in month-on-month terms, the trend continues to strengthen. Respondents are also increasingly positive about the outlook for housing over the next year. Whatever the economic concerns of respondents, housing does not appear to be the major one.

Chart 2: Outlook for Housing Over Next 12 Month (100=Neutral)

Economist David Bowers, global strategist at Absolute Strategy Research commented on the results, “the softer economic activity reported by U.S. households is concerning – but it does not represent a collapse. The improving outlook for housing is encouraging, and we expect further strength in this sector over the coming months.”

“What we find concerning," said Michael Nardis, Senior Vice President at YouGov, "is the deteriorating pace of business activity respondents see at their place of work. While most report no change in activity, we would watch the margins – slightly more now report lower activity than higher.”

There are now fewer than 100 days before the U.S. elections, with the “fiscal cliff” following closely behind. Amid intensifying discussions and analysis of both, it is striking that the confidence in how the government is handling the economy is fairly stable. We would be quick to note that respondents are a long way from being positive about the handling of the economy; that there is minimal deterioration in confidence suggests to us that a situation similar to August 2011 is not on the radar of the U.S. consumer.

Chart 3: Change in Confidence in the Government’s Handling of the Economy (100=No Change)