Nearly half the country say that a college education isn't worth taking on high levels of student debt, and most of the country think student loan repayments should be a percentage of your income instead of a flat monthly amount

At the beginning of June President Obama signed an executive order that would expand the scope of repayment caps on a range of federal students loans. For most loans taken out since 2007 students have been able to limit their repayments to 10% of their income if they choose to, but with the new rules this option would be available to many students who took out student loans before 2007. Traditionally, student debt in the United States has been repaid according to flat monthly dollar amounts that do not vary according to income, though people have been able to get repayment deferred or temporarily lowered in certain cases of hardship or unemployment.

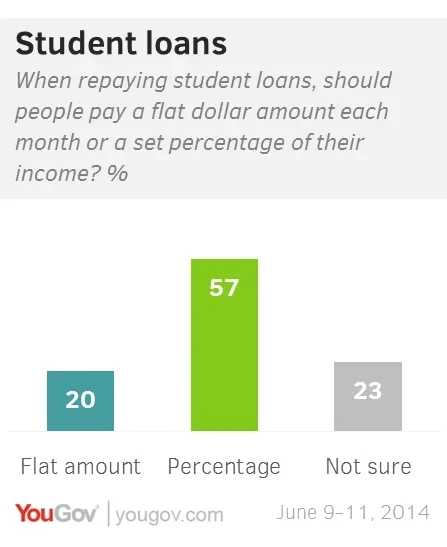

The latest reseach from YouGov shows that only 20% say that monthly payments of a set dollar amount is the best for student loans to be repaid. 57% of Americans think that it is better for student loans to be repaid by taking a percentage of people's incomes, which would see lower-paid graduates pay less each month but would also see higher-earning graduates pay off their loans faster and pay less in interest.

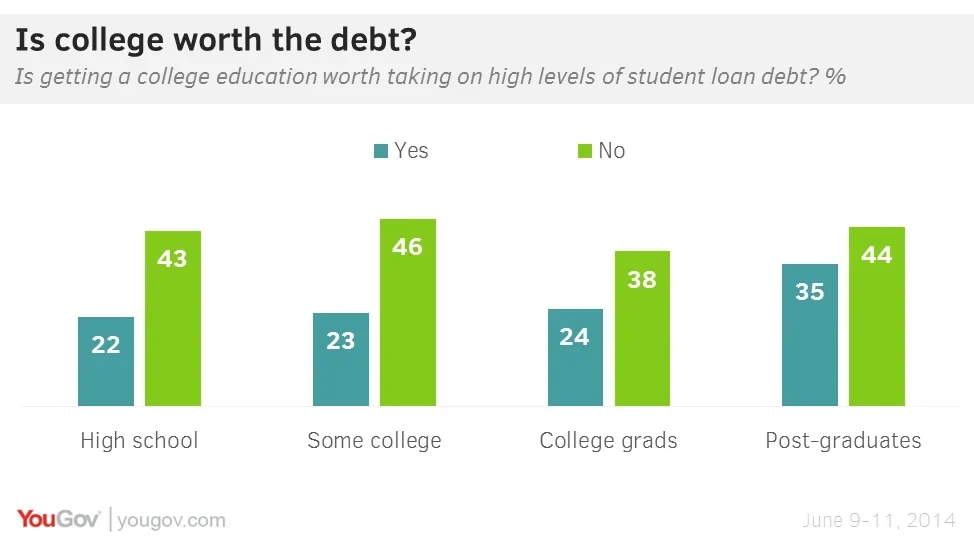

For over two-fifths of the country (43%), getting a college education isn't worth taking on high levels of student debt. Only 24% of the country say that a college education is worth high levels of student debt, with people in the Midwest (18%) being the least likely to say a college education is worth it and black Americans (40%) being the most likely. Significantly, people with a college degree (24%) are not noticeably more likely to say that a college education is worth high levels of debt. Only post-graduates (35%) are more likely to agree, but they are also the second most likely after people with only some college to say that a college degree isn't worth high levels of debt.

Despite this, studies do consistently show that getting a college degree is - in the long-term - a sound financial decision, and one that becomes a better decision with each passing year. College graduates earned 64% more hourly than people without a degree in the early 1980s, but today they earn 98% more on average. This earnings bonus adds up and over the course of an average person's life, when considering both the cost of college and the higher income of graduates, having a degree will net you half-a-million dollars.

Full poll results can be found here.

Image: Getty