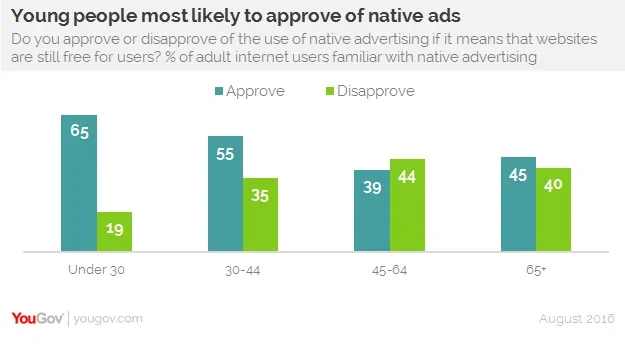

Data reveals that 65% of young people familiar with native ads approve of the practice if it allows online content to remain free

Last December, the Federal Trade Commission issued an enforcement policy and business guide on native advertising, indicating that as the use of native ads continues to grow in prominence, regulators have become increasingly concerned that this use doesn't turn into abuse. The chief anxiety — expressed by both government agencies and certain late-night talk show hosts, alike — is that consumers won't be able to distinguish between editorial content and content designed to make partner brands look good.

According to a new poll from YouGov, only 58% of adult internet users are familiar with the concept of native advertising, which the survey defines as "the practice of placing videos or articles on a website that appear similar to the site’s regular content, but are actually paid ads that promote a product or company."

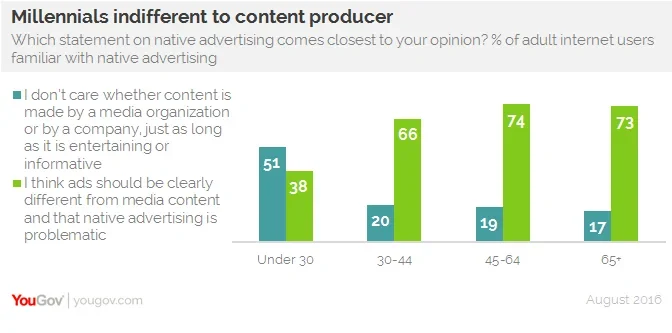

Among those familiar with native advertising, people under the age of 30 are most likely to say they don't care who creates the content they consume, as long as it's entertaining or informative. Indeed, 51% of young people agree with this sentiment, while 38% think native advertising poses a problem. Conversely, people 30 and over are far more likely to think publishers should make native ads easy to identify and that there's something unsettling about the whole business.

At 65%, people under 30 are also the age group most likely to approve of native advertising if the revenue stream can provide websites with the means to keep content free for users. Older people tend to agree with this aspect, too, but at smaller rates (55% of people 30-44 approve, along with 45% of people 65 and up). Those who fall within the 45-64 age range, however, tend to disapprove of native advertising, even if it provides a much needed source of income for news organizations weathering the transition from print to digital.

According to a report from BI Intelligence, native ads are much more effective than traditional banner ads, and their presence is only expected to grow. By 2018, marketers will spend an estimated $21 billion on them, up from $4.7 billion in 2013.

The new data from YouGov, however, suggests that despite the well-intentioned concern surrounding native advertising, young people don't foresee a doom-and-gloom scenario for online publishers. Like advertorials before them, the negative attention toward native ads have a chance of fading with time.