Credit card usage is higher in the US than anywhere else in the world

As countries across the world search for speedier, more convenient ways to pay, one question runs across everyone’s mind – what role will cash play in this future? In a global study on how people in the US, UK, China, Indonesia, Denmark, Sweden, and Germany pay day-to-day, YouGov reveals that while some consumers propel their countries towards a cashless society using mobile payments, Americans in particular are skeptical of the method – and prefer plastic.

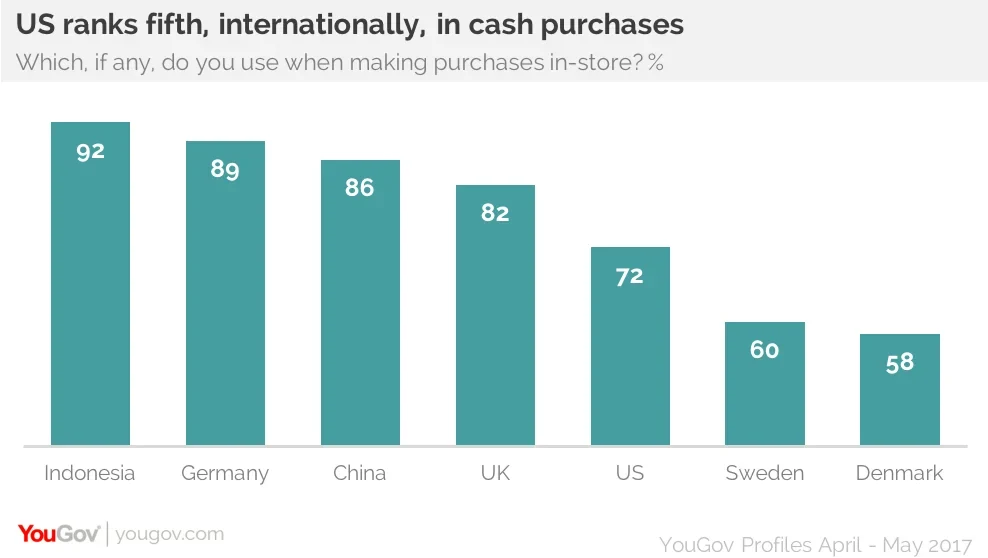

The international report, Cashing-in Globally, begins by addressing the ways people across the world pay for in-store purchases. Nearly three-quarters of Americans (72%) say they use cash to pay sometimes, ranking the US fifth among countries surveyed like Indonesia (92%), Germany (89%), China (86%), and the UK (82%) all of whom boast higher rates of cash purchases.

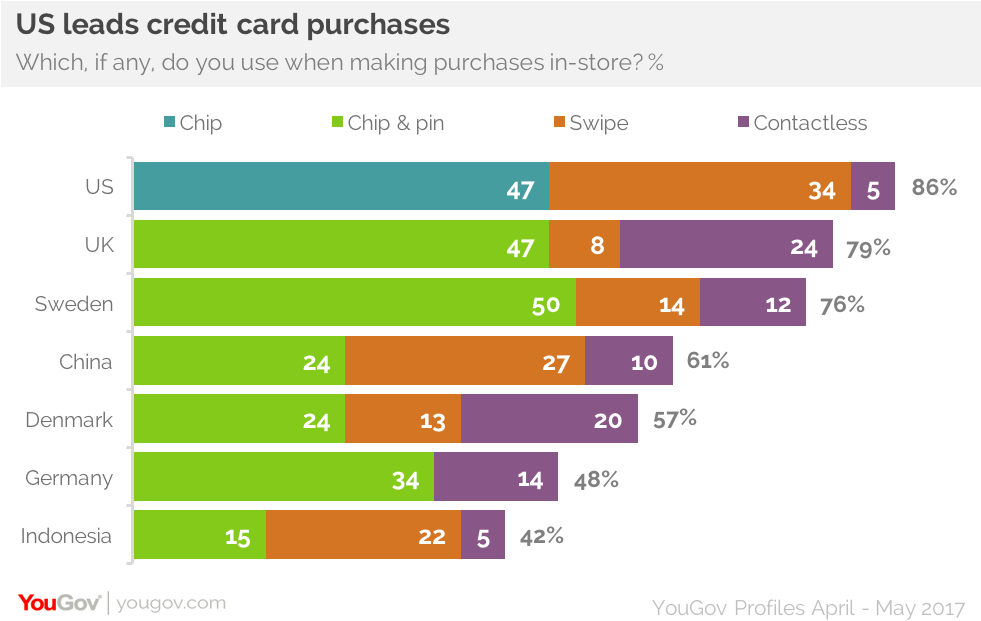

But plastic is the new king of the era, and YouGov Profiles data confirms that the US leads credit card usage with nearly nine in ten Americans (86%) saying they sometimes use cards to pay for their purchases. In the US, the most popular form of credit card payments is with a chip (47%), followed by a third who swipe (34%) and a few who use contactless cards (5%). The countries closest to saying they use credit cards nearly as much as the US are the UK (79%) and Sweden (76%).

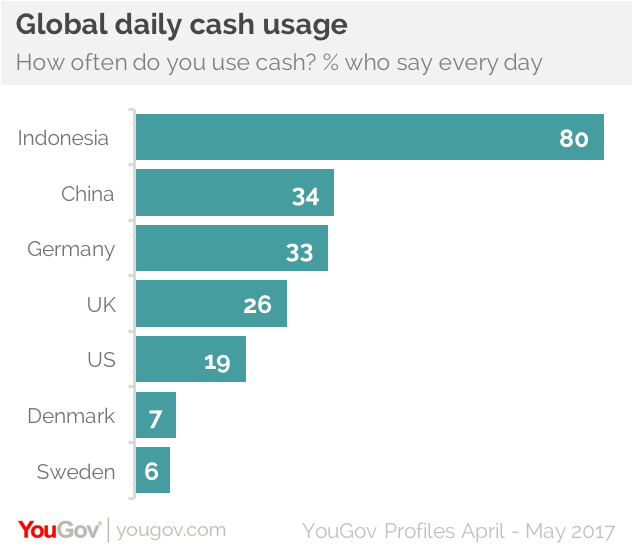

The report is especially timely considering less than one in five Americans (19%) say they use cash every day. To put that in a global perspective, only consumers in Denmark (7%) and Sweden (6%) use cash less than the US while those in Indonesia (80%), China (34%) and Germany (33%) lead all countries in daily cash usage.

The report is especially timely considering less than one in five Americans (19%) say they use cash every day. To put that in a global perspective, only consumers in Denmark (7%) and Sweden (6%) use cash less than the US while those in Indonesia (80%), China (34%) and Germany (33%) lead all countries in daily cash usage.

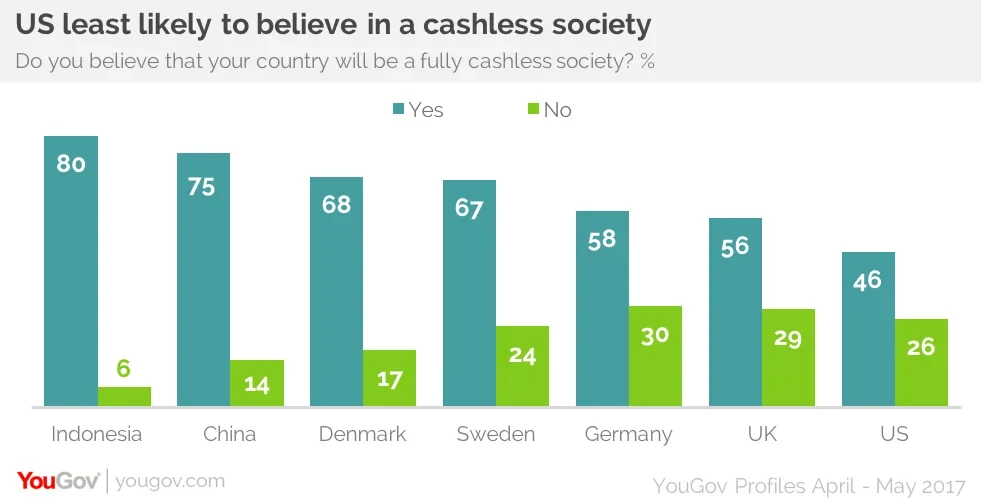

But a fully cashless society isn’t necessarily in the works; a quarter of Americans (26%) say the nation will never be without cash. Less than half (46%) believe that the US will ever be a cashless society – the lowest percentage of belief of all the countries surveyed. Three-quarters of Indonesian consumers believe that someday their country will be fully cashless followed by Danish (68%) and Swedish (67%) consumers.

Download the full “Cashing-in Globally” report here

Learn more about YouGov Profiles and YouGov Omnibus

Image: Getty