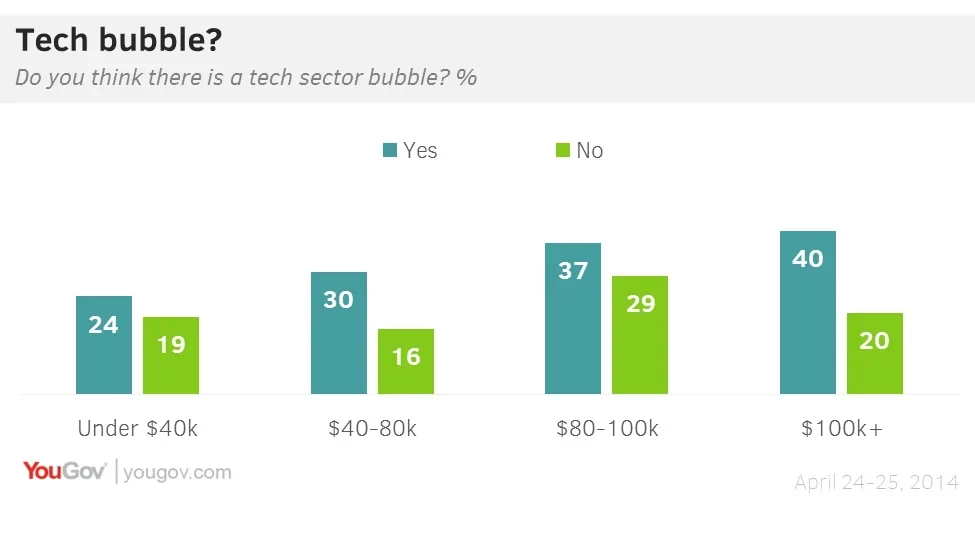

By two-to-one the wealthiest Americans think that there is a tech bubble, and half the country worries what impact the bursting bubble could have on the economy

Last Friday major stock indices - including the tech-heavy NASDAQ - closed down on the week as share prices dropped, prompted by continuing volatility in the tech sector. Amazon lost 10% of its value in a single day after announcing expected losses for the second quarter of 2014. What might just be a blip in the radar may be more serious, however, with news that major figures in the industry itself have begun to unload shares while they can. The sector had been one of the few bright spots in an otherwise gloomy economy, but as the rest of the economy improves the flood of investment seems set to slow at least somewhat, threatening sky high share prices.

The latest research from YouGov shows that while most Americans (54%) aren't sure whether there is a tech bubble or not, the wealthiest people - those most likely to have investment portfolios - tend to think that there is a tech bubble. 40% of people in households earning at least $100,000 per year agree that the tech bubble is real, while 20% say that there is no bubble.

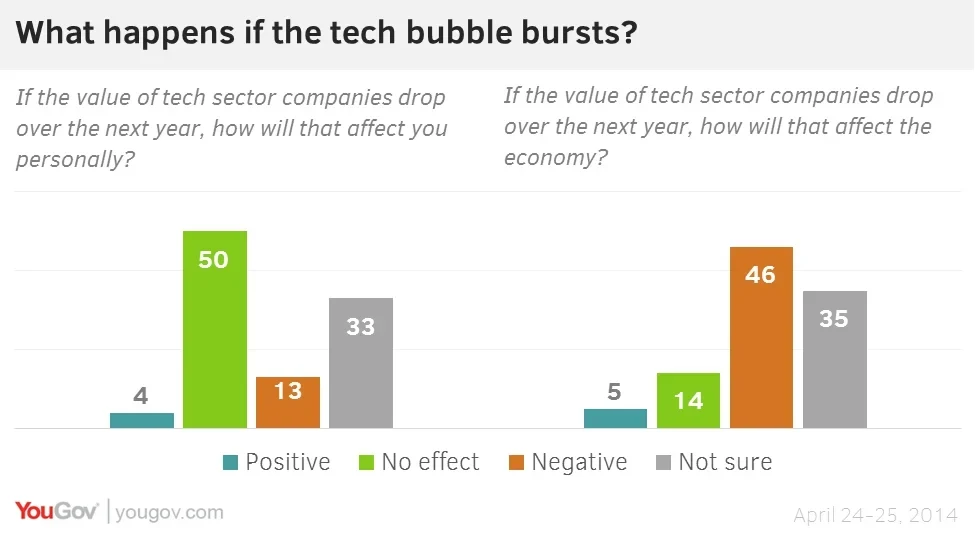

Asked what impact a drop in the value of tech companies would have on them, half the country say that it would have no effect - though 13% said that it would impact them negatively. Asked about the impact on the economy as a whole, however, 46% of Americans say that a drop in the valuations of tech companies would have a negative impact on the national economy.