Three-quarters of Americans use credit cards for at least some of their holiday spending

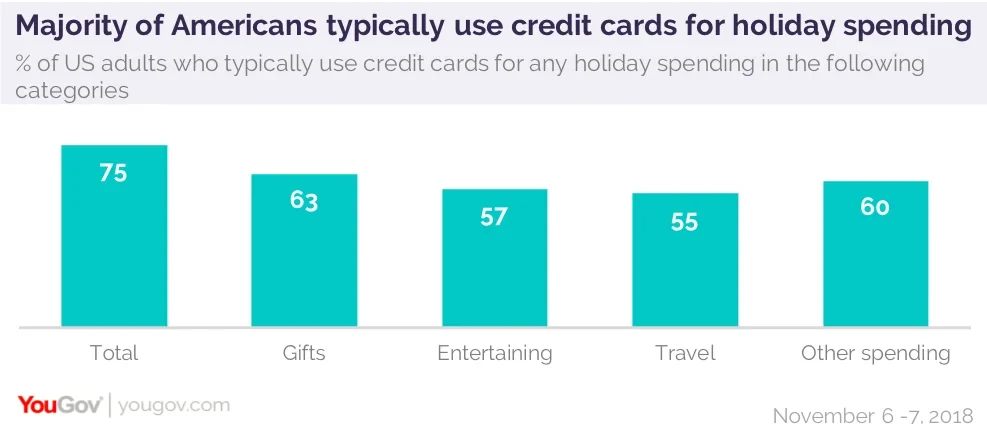

Ho-ho-hooooley moley. The holiday season is here again, and that’s likely to mean a lot of open wallets. The average American spends about of $1,000 on purchases during the holiday season, and many estimates come to that number before even factoring in extra costs such as travel and entertainment. And while cash may be king, YouGov Omnibus data finds that credit is clearly in the line of succession as three-fourths of Americans (75%) say they typically use credit cards for at least some of their holiday season spending.

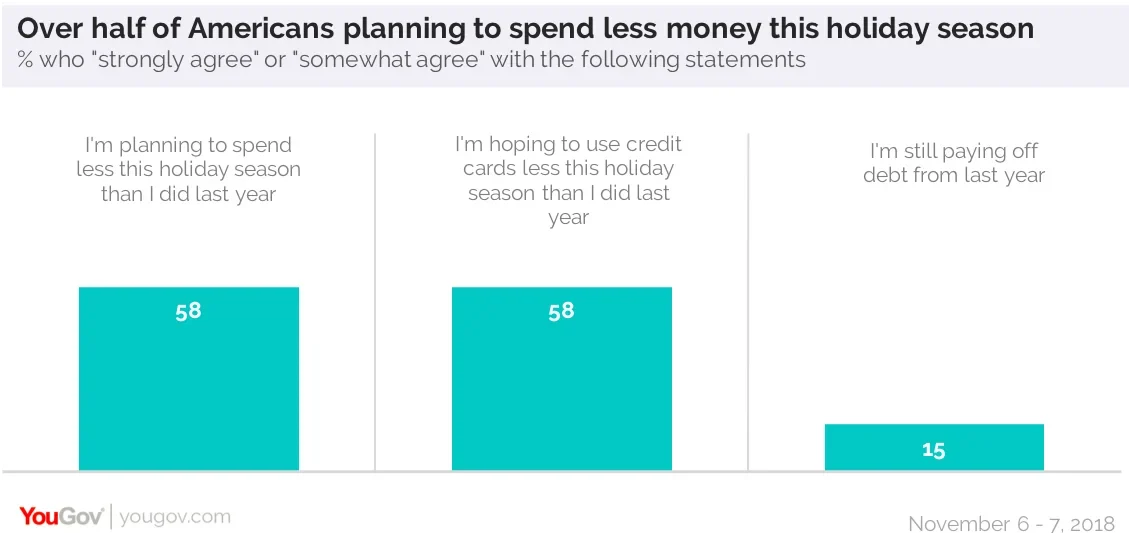

But debt spending can have long term implications – not just to the buyer but to the retail sector as well. Fifteen percent (15%) of Americans – including roughly two in 10 millennials (19%) – say they’re still paying off debt from the 2017 holiday season, which could put a damper on spending in 2018.

Majorities of Americans indicate that they’re planning to spend less and hoping to use credit cards less that they did during last year’s holiday season (58% each), and the ghosts of spending past can have an exaggerated effect on future spending plans. Among those still paying off 2017 holiday season debt, nearly eight in 10 (79%) are planning to rein in their spending this year and roughly three-fourths (76%) are hoping to use their credit cards less.

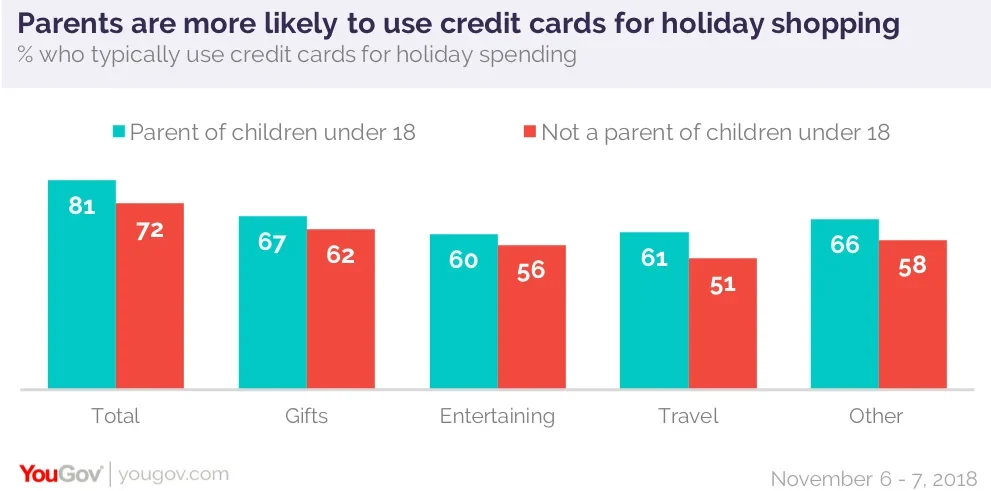

While the respective roles of credit and cash or debit during the holiday season can vary by sector, debt spending plays a role of some sort across all categories tested, with majorities putting at least part of their holiday gifting (63%), entertaining (57%), travel (55%), and other expenses (60%) on a payment plan.

And as anyone who’s read a letter to Santa knows, kids’ wish lists can really add up. Perhaps it’s not surprising, then, that those with children under 18 are significantly more likely to say they typically use credit cards for at least some of their holiday spending (81%, vs. 72% of those without) and that they’re still paying off their holiday debt from 2017 (19% vs. 14%).