Understanding the differences between retail segments can help brands deliver a better experience for their customers. With the pace of change in the pandemic era, it’s critical for marketers to understand what each group looks like today – and how they behave.

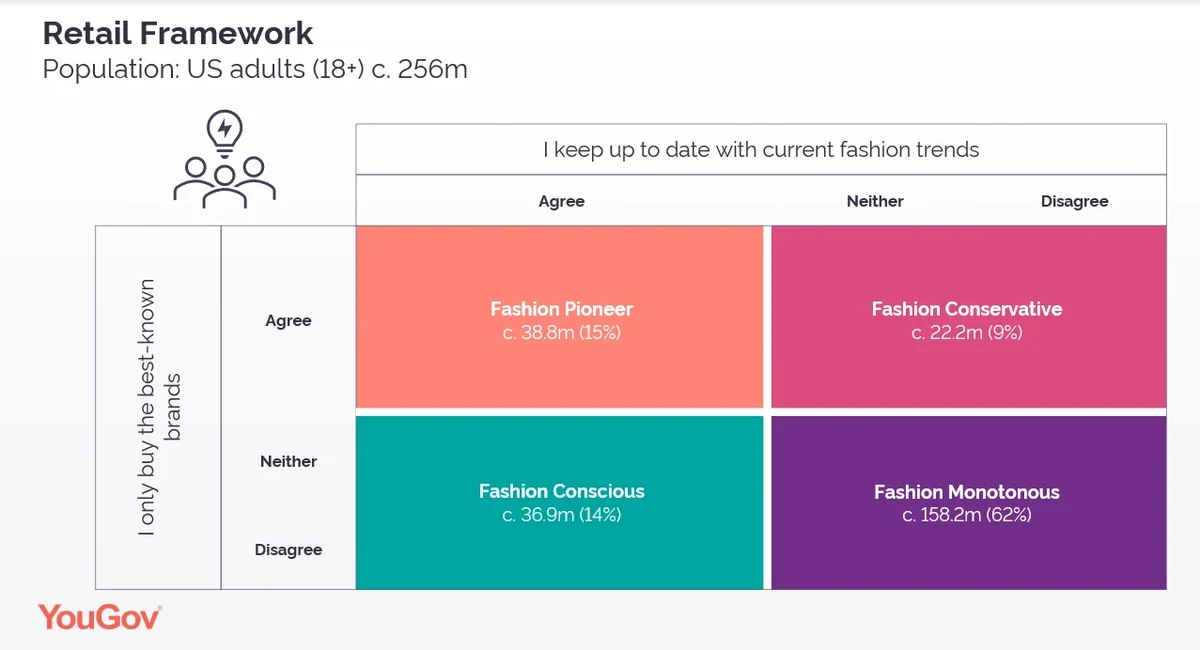

A new YouGov framework, which draws on data from YouGov Profiles, segments American consumers into different categories based on whether they tend to purchase the best-known brands or purchase from brands that are trending.

Fashion Pioneers keep up to date and buy the latest styles from the best-known brands.

Fashion Conservatives buy the best-known brands but do not keep up to date with the latest styles.

Fashion Conscious keep up to date with the latest styles but do not buy the best-known brands.

The Fashion Monotonous do not keep up with the latest styles and neither do they buy the best-known brands. We don’t examine this group in detail here.

Fashion Pioneers

Fashion enthusiasts of the highest order, this group makes up 15% of the US population (market size of 38.8 million US consumers). ‘Fashion Pioneers’ are much more likely to be aged between 18 and 29 (43% vs. 21% of the general public), and, interestingly given the stereotypes, slightly more than half (55%) are men.

Getting to their fashion styles and shopping habits, ‘Fashion Pioneers’ show a higher propensity to spend money on clothes compared to the general public (80% say they spend a lot on clothes vs. 24% of US adults). This retail group is also more likely to say they shop to stand out (77% vs. 31% of the general public) and that they can’t resist branded items, even if the items are expensive (68% vs. 18% of Nat Rep).

As to their spending, nearly two in five ‘Fashion Pioneers’ spend $200 or more per month on clothing, which is almost twice as much as the general population (40% vs. 17%). At least three in ten are also active members of social media networks – 57% are members of Facebook, 33% of Instagram and 29% of Twitter.

Fashion Conservatives

Mainly dominated by men (60%), ‘Fashion Conservatives’ make up 9% of the US population, making it the smallest of the retail segments we analyzed but still a considerable market of 22.2 million US adults. Among this group, 31% of Fashion Conservatives fall between the ages of 18 and 29.

Although a significant share of ‘Conservatives’ (82%) don’t mind paying extra for good quality products there isn’t a big difference between them and the general population (71%). However, they are nearly twice as likely than all US adults to choose premium goods and services (67% vs. 36% nat rep). What’s more, they are 18-points more likely to be willing to pay more for luxury brands (48% vs. 30%).

‘Fashion Conservatives’ show a lower propensity for spending $200 or more on clothing than the other retail segments analyzed but are still more likely to do so than the general population (20% vs. 17% Nat Rep). Their social media behaviors resemble that of 'Fashion Pioneers' – 59% are members of Facebook, 31% of Instagram and 25% of Twitter.

Fashion Conscious

Members of this group keep up to date with the latest styles but do not buy the best-known brands. The demographic make-up of those who are ‘Fashion Conscious’ is close to that of ‘Fashion Conservatives’, with 32% aged between 18-29. But unlike the other two groups, 65% of this group is female. Consumers in this group make up a total of 14% of US adults, equivalent to 36.9 million consumers.

The Fashion Conscious are also often on the lookout for discounts and say they use coupons or take advantage of deals when they shop (77%). Almost three quarters like trying new brands and 86% like to think of themselves as well dressed.

Even though this group is categorized as those who keep up to date with the latest styles, 30% of them spend $200 or more per month on clothing (compared to 40% of our Pioneers). The data also reveals that among the groups analyzed, the ‘Fashion Conscious’ are the most active group on social media – 68% on Facebook, 45% on Instagram and 32% on Twitter.