As American cardholders are more likely to have their cash stolen via a security breach than from physical theft, almost half the nation (46%) believes banks are not doing enough to secure their customers’ card details. 30% say banks and financial institutions are doing enough to prevent breaches.

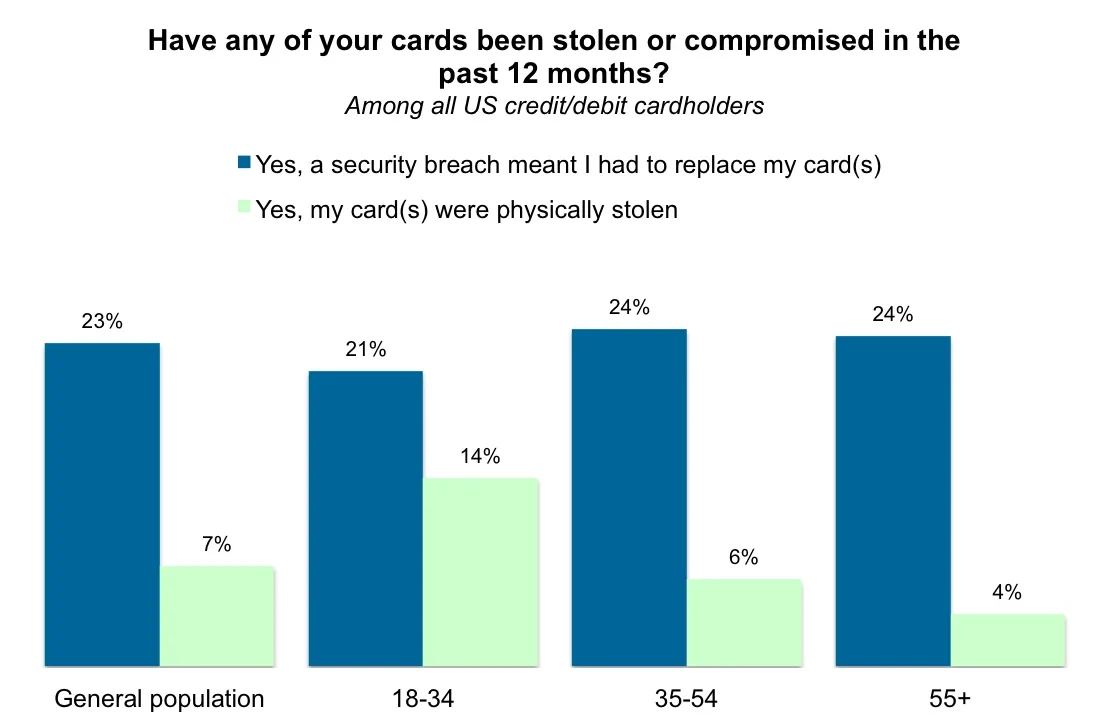

A quarter of American credit and debit cardholders (23%) have had their card information stolen in the past year, requiring them to replace one or more cards – and most of these people (66%) had money stolen as a result of the breach. This compares with a small minority of American cardholders (7%) who have had their cards physically stolen in the past year.

Older are more vulnerable to data breaches

Millennials are more prone to physical theft, while a data breach is more likely to affect older Americans. 14% of 18-34 year old cardholders, 6% of 35-54 year olds and 4% of over-55s have had cards physically stolen from them in the last 12 months. A data breach has affected 21% of 18-34 year olds, 24% of 35-54 year olds and 24% of over-55s in the past year.

Physical theft was most likely in the Northeast, where 10% have had their card taken, compared with 8% in the South, 7% in the Midwest and 5% among those living in the West. Data breaches were more likely in the West, where 29% have had to replace a card due to a security breach, compared with 18% in the Northeast, 23% in the South and 21% in the Midwest.

Higher earners reported they are more likely to have suffered a security breach in the past year, with 30% having to change their cards (earning more than $80,000) compared with 21% among lower earners (earning less than $40,000). This was the opposite case for physical theft, where 5% of higher earners and 11% of lower earners said they had a card stolen in the past year.

Three in four fraud victims were ‘reimbursed quickly’

Out of Americans who have experienced a security breach in the last year, two-thirds (66%) had their money stolen from them – but how quickly do financial institutions respond to these breaches?

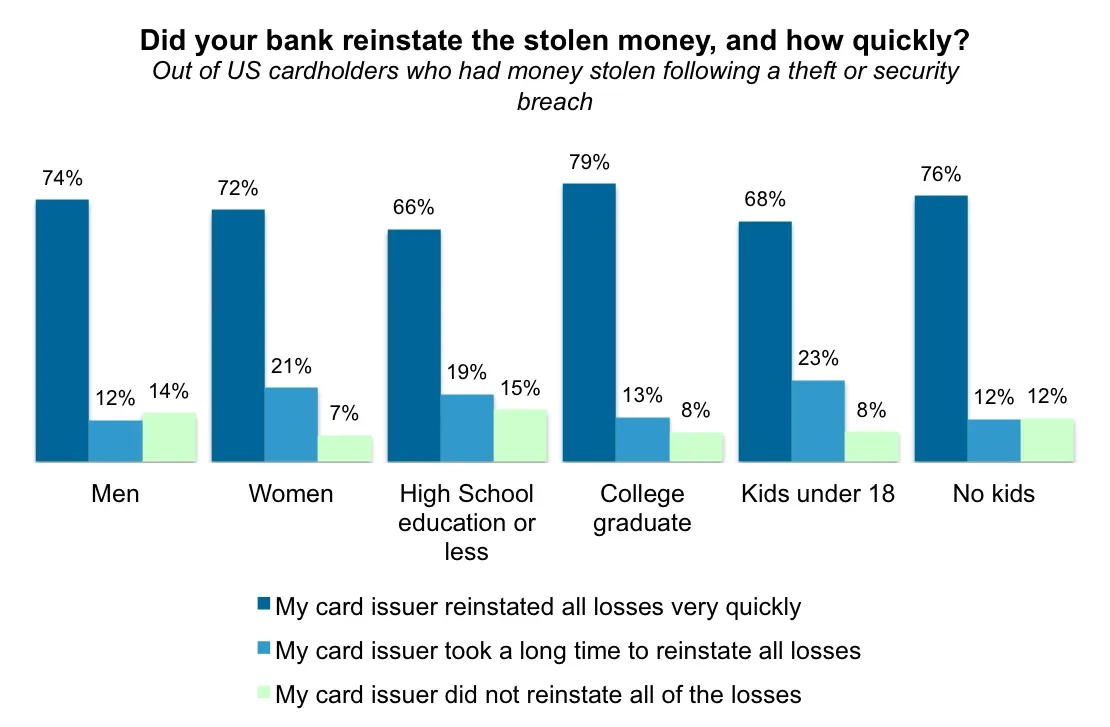

Three quarters of Americans (73%) state they were reimbursed quickly – but of the remaining quarter (27%) that say they were not, there is a different story among gender and age groups.

Women more success with recovering lost funds

Twice as many men as women – 14% of men and 7% women – say they didn’t get reimbursed at all after money was taken from a security breach. Women are more likely to have waited a long time, but eventually got reimbursed, (21% of women versus 12% of men).

The likelihood of a speedy reimbursement increases with age – 84% of those aged over 55 said their bank resolved the theft quickly, and 64% among those aged between 18 and 34. Younger people are more likely to have waited a long time (21% of 18-34s and 8% of over-55s) or not be reimbursed at all (15% of 18-34s and 8% of over-55s).

When broken down by education, 79% of college grads say they were reimbursed straight away versus 66% of Americans educated to high school. Lower earners were less successful in getting money back from the bank: 67% of victims earning under $40,000 versus 78% among those earning over $80,000.

Parents tend to have less luck with reimbursements from their bank, as 68% of Americans with children under the age of 18 say they were reimbursed after a theft, and 76% among people without kids – suggesting that time-strapped young families may have less time to chase down the bank, and could be less likely to recoup their lost money.

Americans who have had more than one of their cards affected in a security breach find it more difficult to get a reimbursement straight away. 78% of those who had just one card subject to a breach were reimbursed straight off, compared with 63% when more than one card was infiltrated.

Generally victims of a security breach say they are happy with the way their card issuer responded to the problem, with 82% saying they were satisfied with the response, and 12% responding they were not satisfied.

Stores lacking security get biggest blame

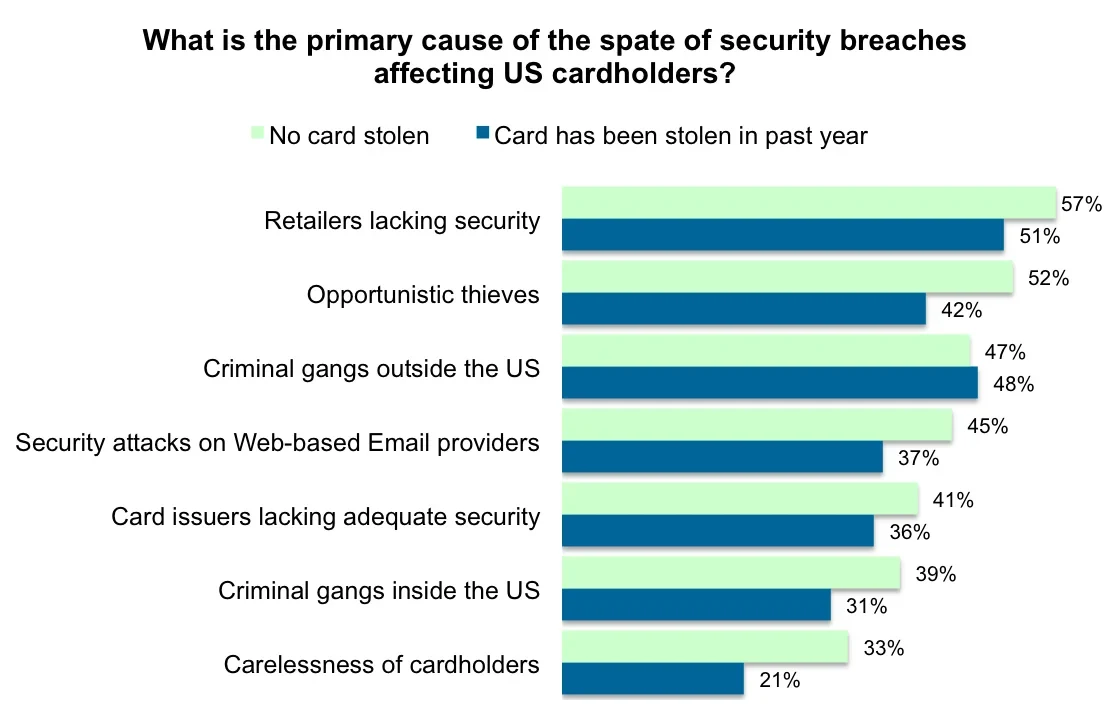

Retailers who fail to protect their customers’ card details are seen as the primary cause of the spate of credit card security breaches in the US. 53% of Americans – with the highest proportion among over-55s (58% among this age group) – tipped shops as the top danger to US card holders.

The FBI recently warned US online retailers to prepare for further cyber attacks, after a series hacking cases were discovered during the holiday shopping season, with major retailer Target being subject to one of the biggest cyber-retail attacks in history. The FBI has also sent a report to stores warning them about malware that can infect cash registers and credit-card swiping machines in checkout aisles.

Opportunistic thieves are the primary problem for 47% of Americans, while security attacks on web-based mail providers such as Yahoo, Gmail and Microsoft are blamed by 42% for the recent card detail security breaches.

Criminal gangs operating outside the US are seen as more of a problem than those inside the country. More Americans (44%) blamed gangs operating outside the country than respondents who thought criminals inside the US were the primary cause of breaches (35%).

Are banks doing enough?

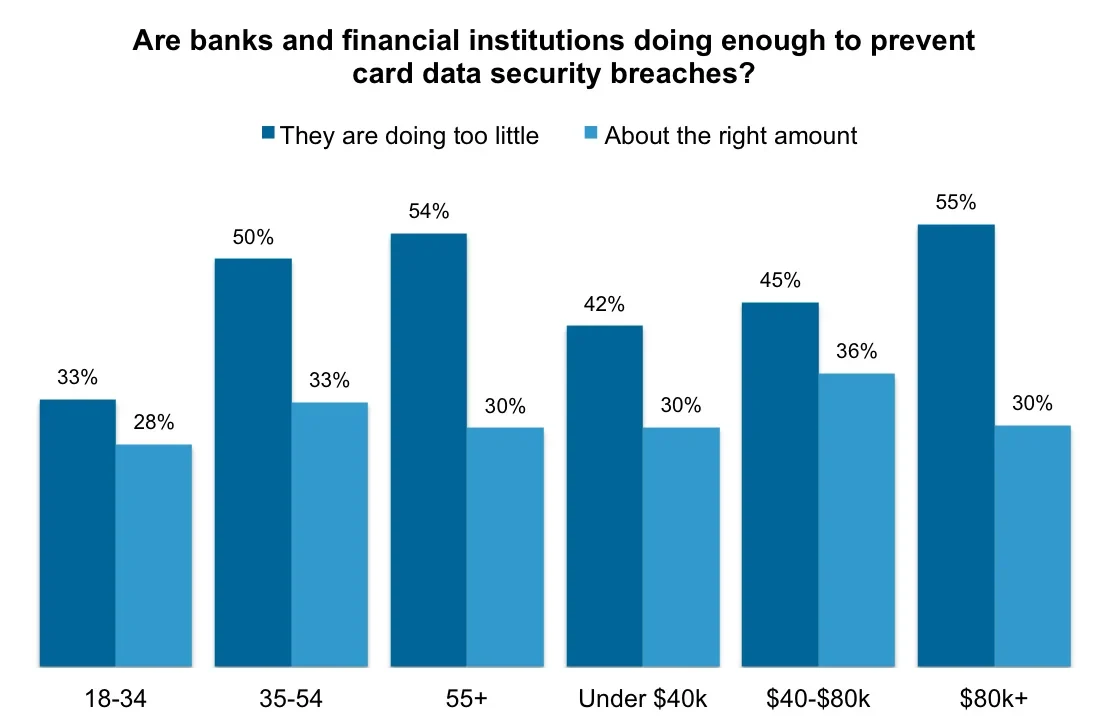

Almost half (46%) of Americans say that banks are not doing enough to protect their customers against credit card fraud, with a higher proportion of men saying banks do too little (51%) than women (42%). Just under one third (30%) of Americans think card issuers are doing enough to prevent security card breaches.

Younger Americans are more likely to be unsatisfied at the work of banks in preventing fraud. 33% of 18-34 year olds, compared with 54% among over-55s, say banks are doing too little. Education also affects our attitudes, as 39% of Americans educated up to high school say banks are doing too little, compared with 50% among people with a college degree and 58% of Americans with a postgraduate qualification.

Chip and PIN remains relatively unfamiliar

Just one third of Americans have heard of 33% the term ‘Chip and PIN’, the card payment solution that requires a 4-digit number to complete transactions in a store. Just one quarter of women have heard of the Chip and PIN, compared with 42% of men.

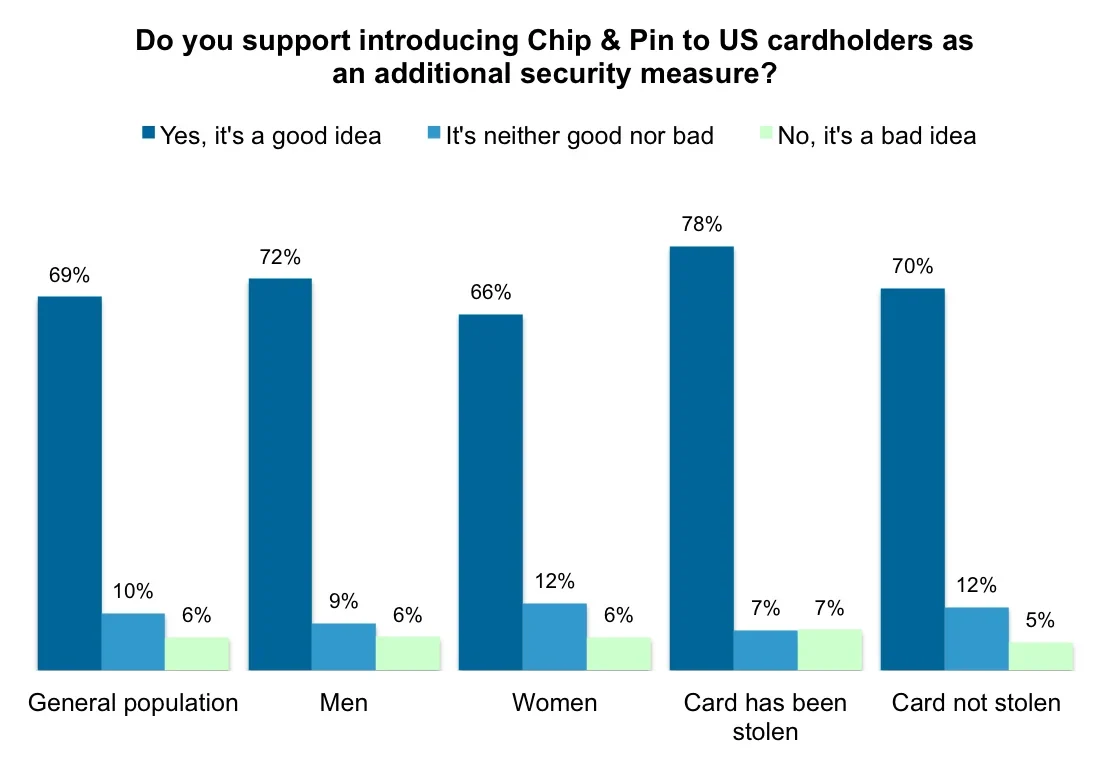

69% of Americans think proposals to introduce Chip and PIN to the US, which would replace the current swipe card system, are a good idea for improving card security. Support is higher among men (72%) than among women (66%).

Younger respondents, despite being the group generally thought to be open to new technology, are less open to supporting Chip and PIN than older Americans – 65% among 18-34 year olds and 73% among over-55s.

When asked if Chip and PIN is a good solution to prevent data security breaches, the nationally-representative survey found:

- 60% of Americans believe Chip and PIN could cut down breaches

- 63% of men and 56% of women agreed

- 18-34 year olds (53%) were less inclined to think Chip and PIN would improve security than over-55s (66%)

- Among Americans who agreed Chip and PIN would prevent breaches, there was a regional divide between those living in the North East (66%), South (62%), West (59%) and Midwest (52%)

- Those educated up to high school (53%) are less likely to feel it would prevent breaches than those with a postgrad degree (75%)

- Lower earners were less likely to agree (49% among those earning less than $40,000) than higher earners (71% among those earning $80,000 or more)

- Among Americans who have had their card scammed, 72% feel Chip and PIN would improve security, and 62% among those who haven’t

For further information about poll results, and for details about methodology and omnibus services, please email omnibus.us@yougov.com.

Find the full results here.

Image: Getty