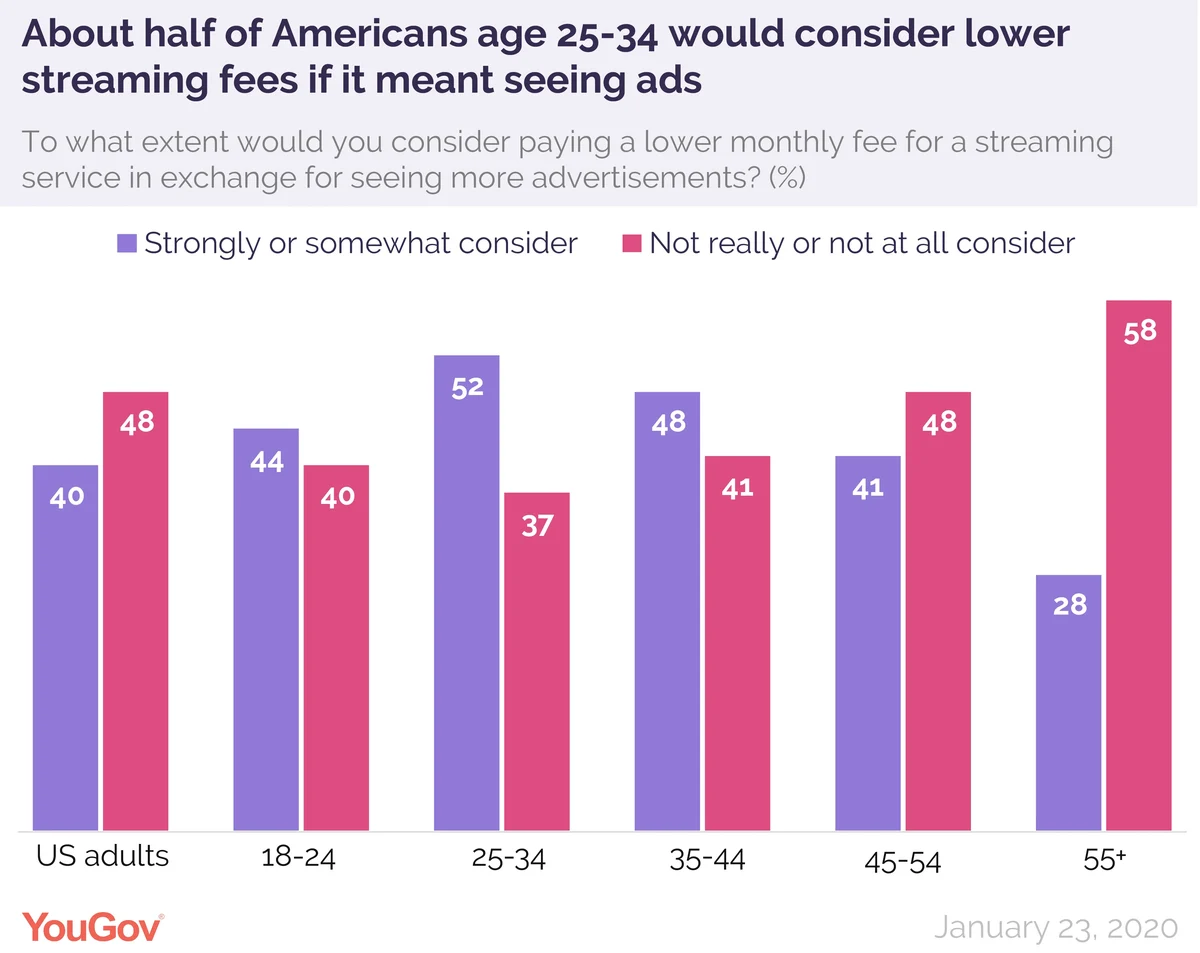

Many Americans — particularly young ones — express interest with the idea of watching more ads in exchange for a lower cost for a streaming service.

While content is the main battleground for new and existing streaming competitors (hence why classic TV shows like The Office are commanding nine-figure rights deals), the price tag is also top of mind when it comes to choosing a streaming service.

HBOMax, launching in May 2020, will have a $14.99 monthly fee with possible plans for a lower tier in the future, while at the other end of the spectrum, NBCUniversal’s Peacock service can be enjoyed free of charge — with ads.

According to recent YouGov data gathered for Adweek, 40 percent of Americans would strongly (15%) or somewhat (25%) consider paying a lower monthly fee for a streaming service in exchange for seeing more advertisements. Many (48%) would not really or not at all consider it.

Young Americans are more likely to strongly consider such a deal: those aged 25-34 saying they’d consider ad-supported streaming tier (52%).

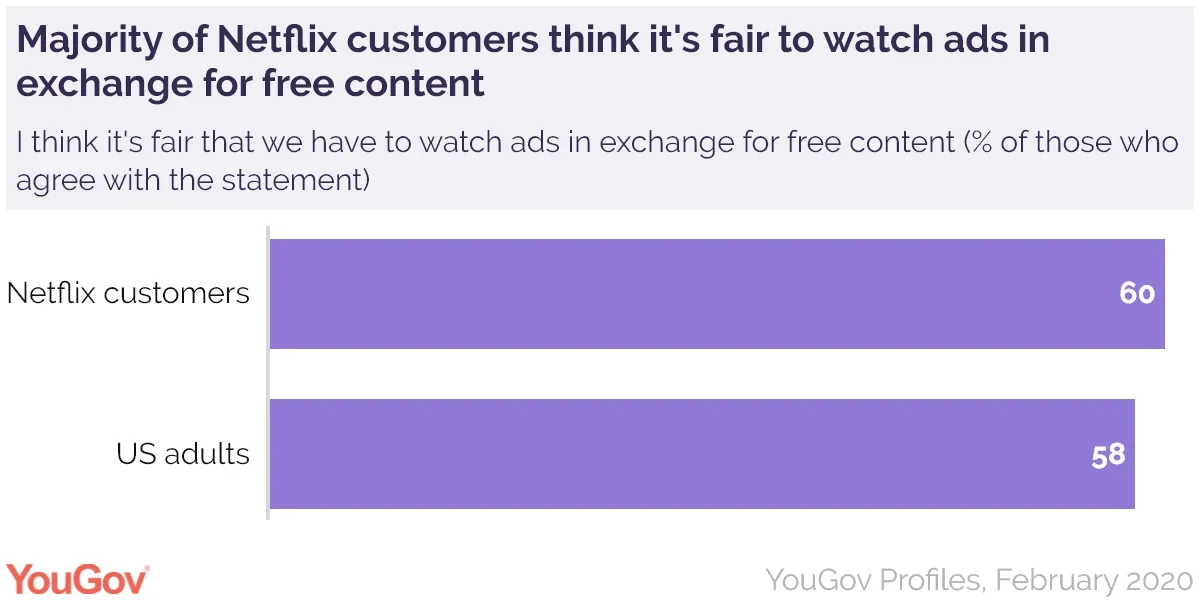

Netflix, which has increased its monthly fee over the last few years to $12.99 ($15.99 for premium), insists it won’t take the same route as its competitors and is committed to remaining ad-free.

“We’ve got a much simpler business model, which is just focused on streaming and customer pleasure,” Netflix CEO Reed Hastings told investors in January.

That’s despite YouGov Profiles data that suggests Netflix customers — and US adults in general — think it’s fair to have to watch advertisements in exchange for free content.

Ultimately, because customers don’t spend as much on streaming services as they do on linear television, price for streaming services remains a major factor in attracting new users. According to a survey data compiled by YouGov in late 2019, a plurality (37%) of Americans spend under $20 on streaming services per month.

Meanwhile on the content battlefront, Peacock is leveraging NBC’s live TV offerings to differentiate itself from the streaming herd, offering programming such as Olympics coverage and Ryder Cup coverage to its users.

A separate YouGov survey reveals there’s also some appetite for streaming platforms to air live awards shows. Close to a third (32%) of Ameicans are at least somewhat interested in watching live award shows, like the Grammy Awards or the Oscars, on their favorite streaming service instead of on live TV.

Image: Getty

Explore more recent findings on streaming:

How many streaming services are Americans willing to pay for?

Disney+ ranks highest in satisfaction scores

Netflix dominates YouGov’s US Buzz Rankings for the second straight year

Old favorites, Olympics will be big draw for NBC’s new streaming service