The notion that Americans should get a "tax receipt" has gotten a lot of attention. Third Way has promoted the idea and developed an on-line calculator that actually provides one. The White House has a calculator too. The idea is that any American should be able to see where their tax money goes - what percent to Medicare, national defense, education, and so on. Ezra Klein called it a "dead-obvious reform."

It is true that Americans do not always have an accurate understanding about how the federal government spends its money. They dramatically overestimate spending on foreign aid, to choose perhaps the most glaring example. Does getting "the facts" through a tax receipt change how they think about taxation or the federal budget?

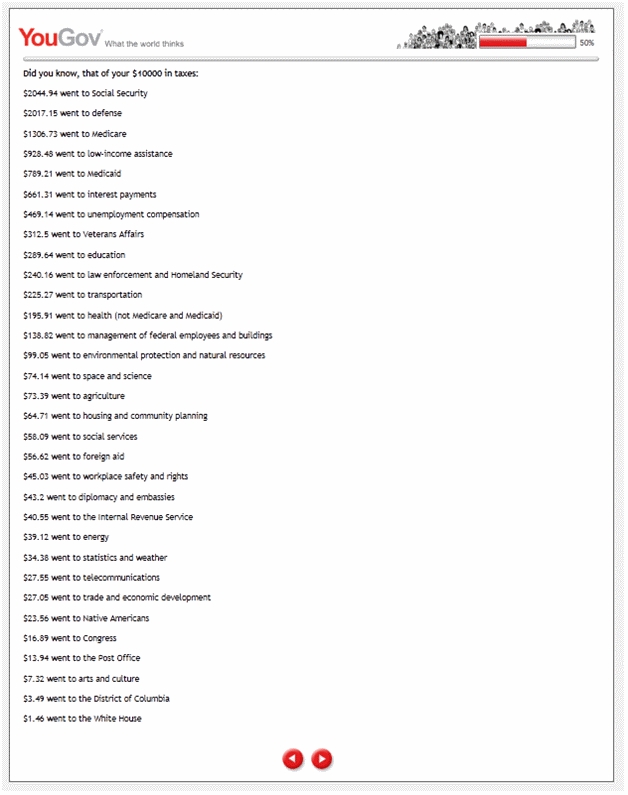

In a YouGov survey conducted in May 2011, respondents were given the opportunity to enter their estimated federal tax and then, for respondents who reported paying at least some tax, a random half was presented with a tax receipt modeled on Third Way’s. Here is what someone paying $10,000 in tax would have seen:

All in all, 15% of respondents did not answer the question asking them to provide their tax. About 30% reported paying no tax by entering $0. (Far fewer than 30% of Americans pay no federal tax, so it may be that some of these respondents were thinking of the federal income tax. About 45% of households paid no federal income tax in 2010). Of the remaining 55% of the sample, half were then assigned at random to see their tax receipt.

Immediately thereafter, respondents were asked two questions about taxation:

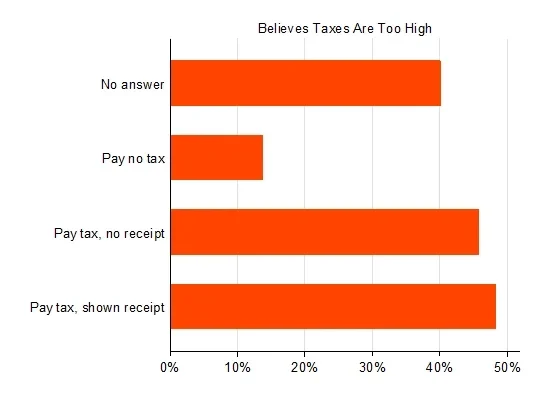

- "Do you consider the amount of federal income tax that you have to pay too high, about right, or too low?" This question has been asked by Gallup for many years.

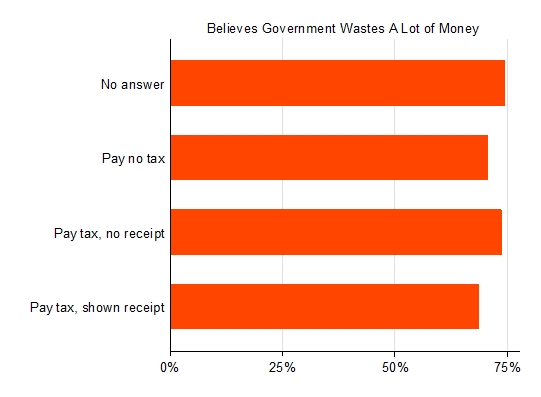

- "Do you think that people in the government waste a lot of money we pay in taxes, waste some of it, or don’t waste very much of it?" This question has been included in the American National Election Studies since 1958.

Here is the percent of respondents who believed their federal income tax was "too high," broken down by each of the 4 groups:

Naturally, those who reported paying no federal tax were much less likely to believe that their federal income taxes are too high. Opinions in the other three groups were similar: about 46-48% of each said that their taxes were too high. (Most of the remainder said that they were "about right"; only about 6% of respondents said they were "too low"). Among those who reported paying federal tax, there was no difference between those who saw their tax receipt and those who did not.

The tax receipt also had little effect on beliefs about government waste: 74% of those who saw the receipt said that the government wastes "a lot of the money we pay in taxes," a sentiment shared by 69% of those who pay federal tax but did not see the receipt. This 5-point difference is not statistically significant.

It is also possible that a tax receipt might change how people make trade-offs between spending categories and the budget deficit. For example, if people learn that a large fraction of federal tax (13%) goes to Medicare, perhaps they might be more willing to cut Medicare to reduce the deficit.

The survey included this series of questions based on a recent Washington Post-ABC News poll:

In order to reduce the national debt, would you support or oppose…

- Cutting spending on Medicare

- Cutting spending on Medicaid

- Cutting military spending

- Raising taxes on incomes over $250,000

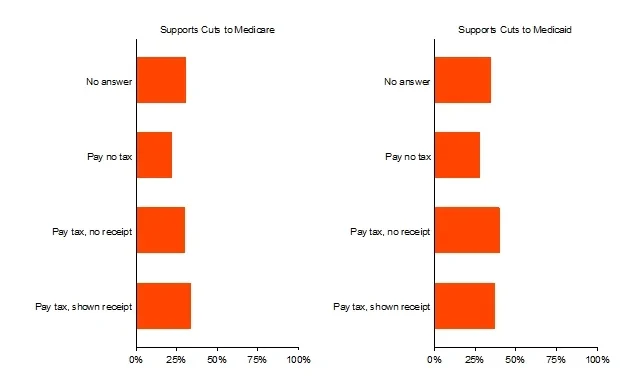

Cuts to Medicare or Medicaid were relatively unpopular: only 28% and 34%, respectively, supported them. But it did not matter whether respondents were shown a tax receipt.

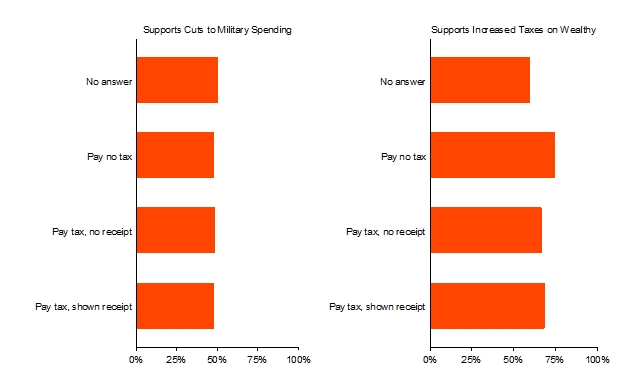

Cutting military spending and raising taxes on the wealthy were more popular. Again, opinions depended little on whether respondents saw their tax receipt.

A tax receipt may be a valuable reform, even if it does not change how Americans feel about their taxes or how they might attempt to cut the budget deficit. Nevertheless, it is perhaps surprising that the receipt had such small effects in this experiment, given how little many Americans know about how the government spends its money.

One possible reason for these small effects was anticipated by two of the tax receipt’s proponents, David Kendall and Ethan Porter, who wrote "Ultimately, a taxpayer receipt would be a political Rorschach test. In it, people would see what they already believe is right or wrong about government spending." If so, then we might expect the correct facts presented in a taxpayer receipt to buttress existing partisan or ideological arguments, not to supplant them.

Photo source: John Morgan