A recent YouGov poll finds that two-thirds of Americans support canceling some amount of student loan debt for all people who currently hold it. Most Americans say the cost of attending college has risen dramatically over the past 20 years and nearly all lay some blame on colleges’ rising administrative costs, while majorities also blame federal and state governments as well as banks and other lending institutions. While only one in three approve of how Joe Biden is handling the issue of student debt, a majority of people support the plan he has recently floated, which involves canceling around $10,000 in federal student loan debt for each borrower who owes at least that much.

The cost of a college education

Most Americans say that the cost of attending college has increased a lot in the past 20 years, and two-thirds say that college costs more in the United States than in other Western countries. Most people agree that investing in college means investing in the economic future of our country, and a majority say that investing in college helps the U.S. compete against other countries.

However, seven in 10 Americans say that colleges in the U.S. have become too much like corporations. This may be one reason why more than half of people (53%) support making all public colleges and universities tuition-free. In addition to supporting more government investment in colleges, the vast majority of Americans also say the government should invest more in trade schools, as well as other college alternatives.

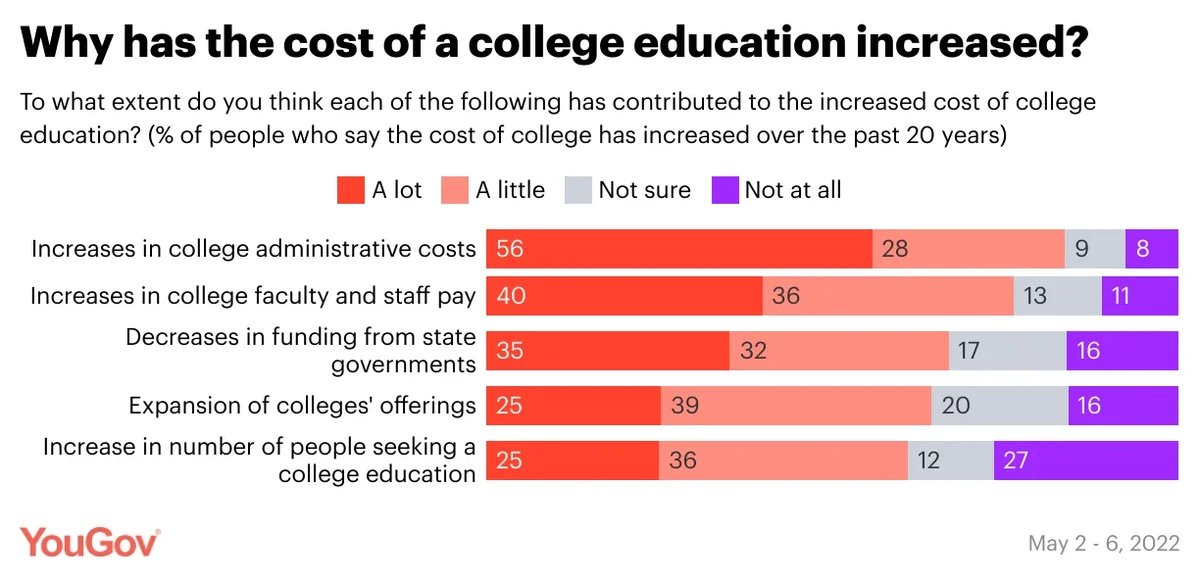

What factors do Americans think have contributed to rising college costs? When asked to evaluate a list of possible reasons, people who said the cost of college is increasing say each of the following has contributed either a lot or a little, listed from most blamed to least:

- Increases in college administration costs (56% say a lot; 28% say a little)

- Increases in college faculty and staff pay (40% lot; 36% a little)

- Decreased funding from state governments (35% a lot; 32% a little)

- Expansion of colleges’ offerings (25% a lot; 39% a little)

- Increase in the number of people seeking college education (25% a lot; 36% a little)

Who is to blame for student debt

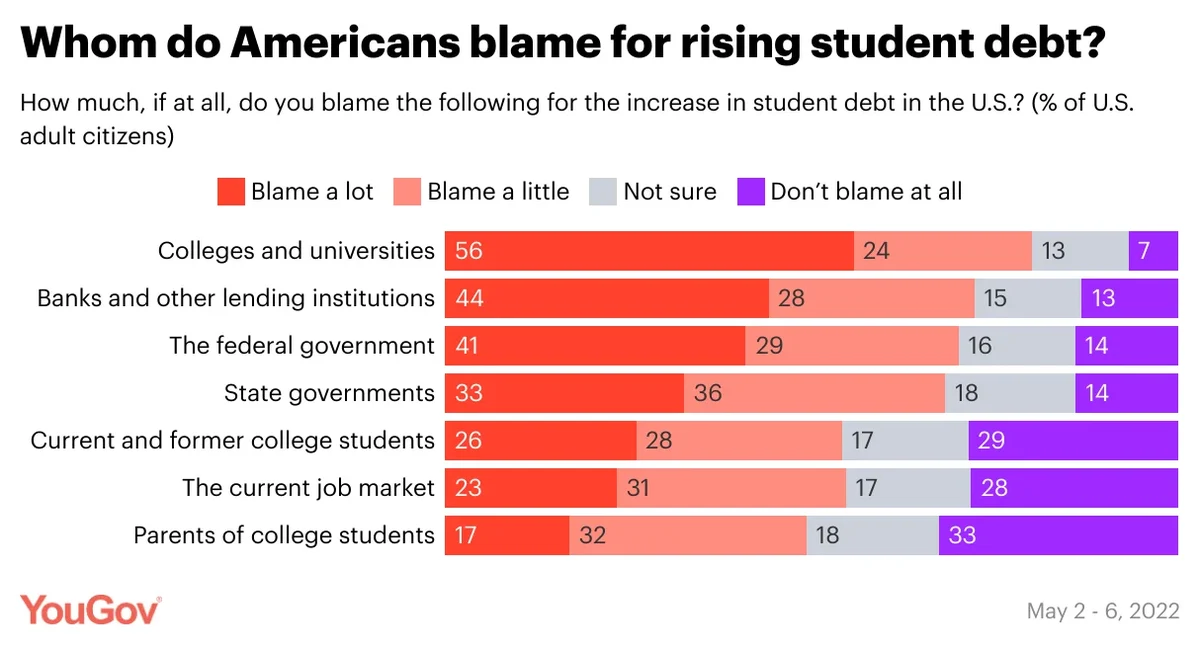

Three-fourths of Americans say that college debt is a very or somewhat serious problem in the U.S. When asked how much they blame seven different entities for the increase in student debt, Americans responded with the following:

- Colleges and universities (56% blame a lot; 24% blame a little)

- Banks and other lending institutions (44% blame a lot; 28% blame a little)

- The federal government (41% blame a lot; 29% blame a little)

- State governments (33% blame a lot; 36% blame a little)

- Current and former college students (26% blame a lot; 28% blame a little)

- The current job market (23% blame a lot; 31% blame a little)

- Parents of college students (17% blame a lot; 32% blame a little)

Responses to the student debt crisis

Half of Americans say the government should do more to help students pay off their student-loan debt, while one in three say it’s not the government’s job to help people pay for college. However, most Americans – including half of those who say the government should help with student debt – say that lowering the cost of attending college for future students should be prioritized over helping people repay loans they already have.

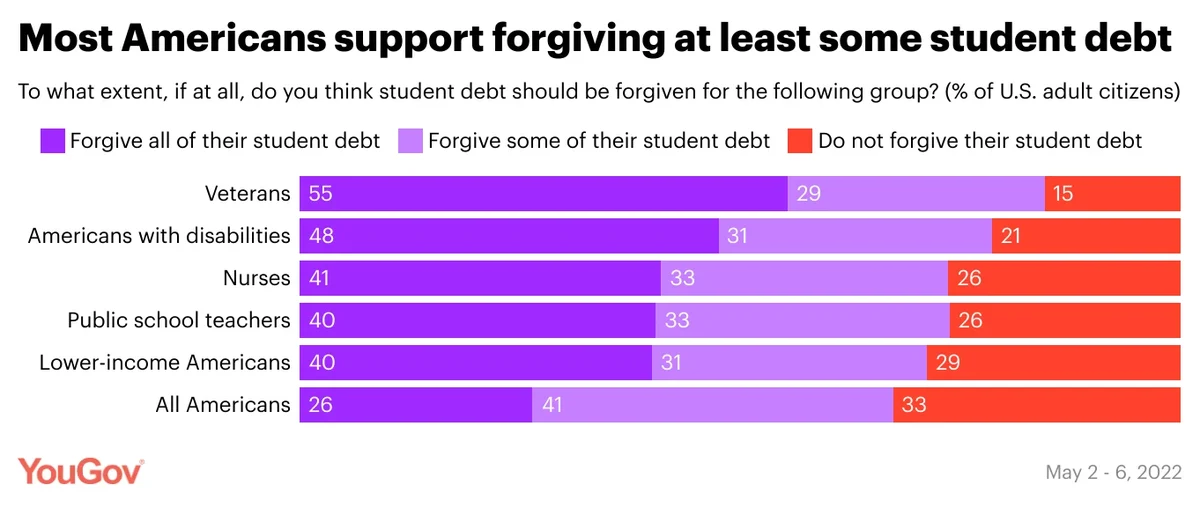

Two-thirds of Americans (67%) support forgiving at least some of the student debt held by all Americans. Support for forgiving student debt among specific groups of Americans polled about is even higher: 84% support forgiving veterans’ debt, 79% support forgiving Americans with disabilities’ debt, 74% support forgiving nurses’ debt, 73% support forgiving public-school teachers’ debt, and 71% support forgiving low-income Americans’ debt.

When asked which groups of people should have some or all of their student debt forgiven, Americans responded with the following:

- Veterans (55% say all should be forgiven; 29% say some should be forgiven)

- Americans with disabilities (48% say all; 31% say some)

- Nurses (41% say all; 33% say some)

- Public-school teachers (40% say all; 33% say some)

- Low-income Americans (40% say all; 31% say some)

- All Americans (26% say all; 41% say some)

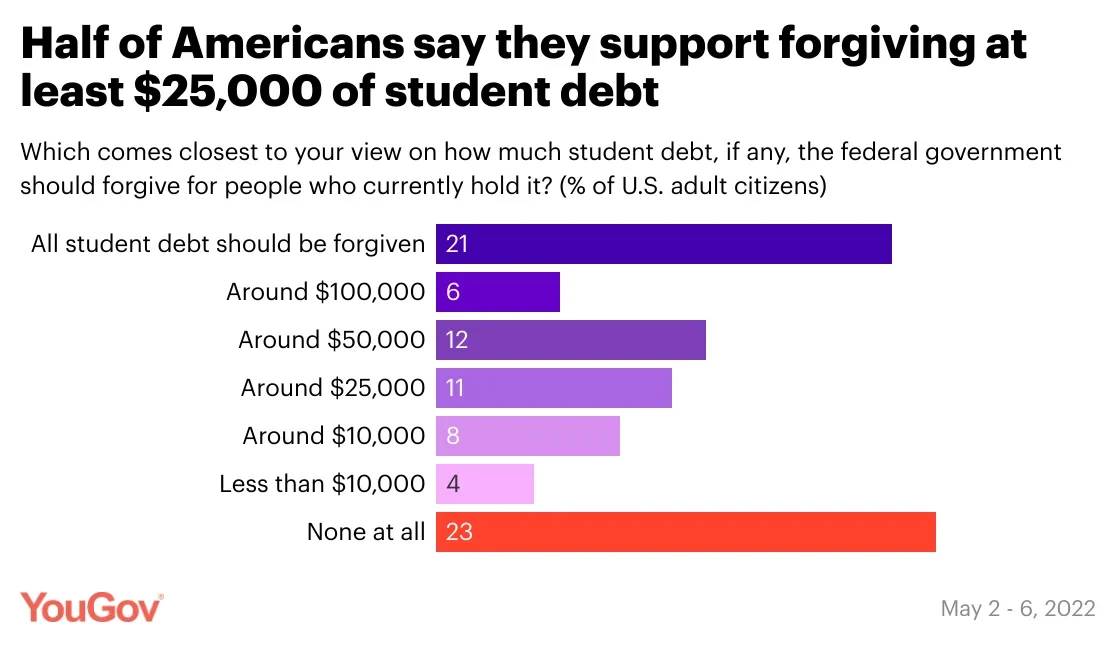

When asked how much student debt should be forgiven, 21% say all debt should be forgiven, while 23% say none of it should be. About one in 10 (12%) say $10,000 or less should be forgiven, and 26% say between $25,000 and $100,000 should be forgiven.

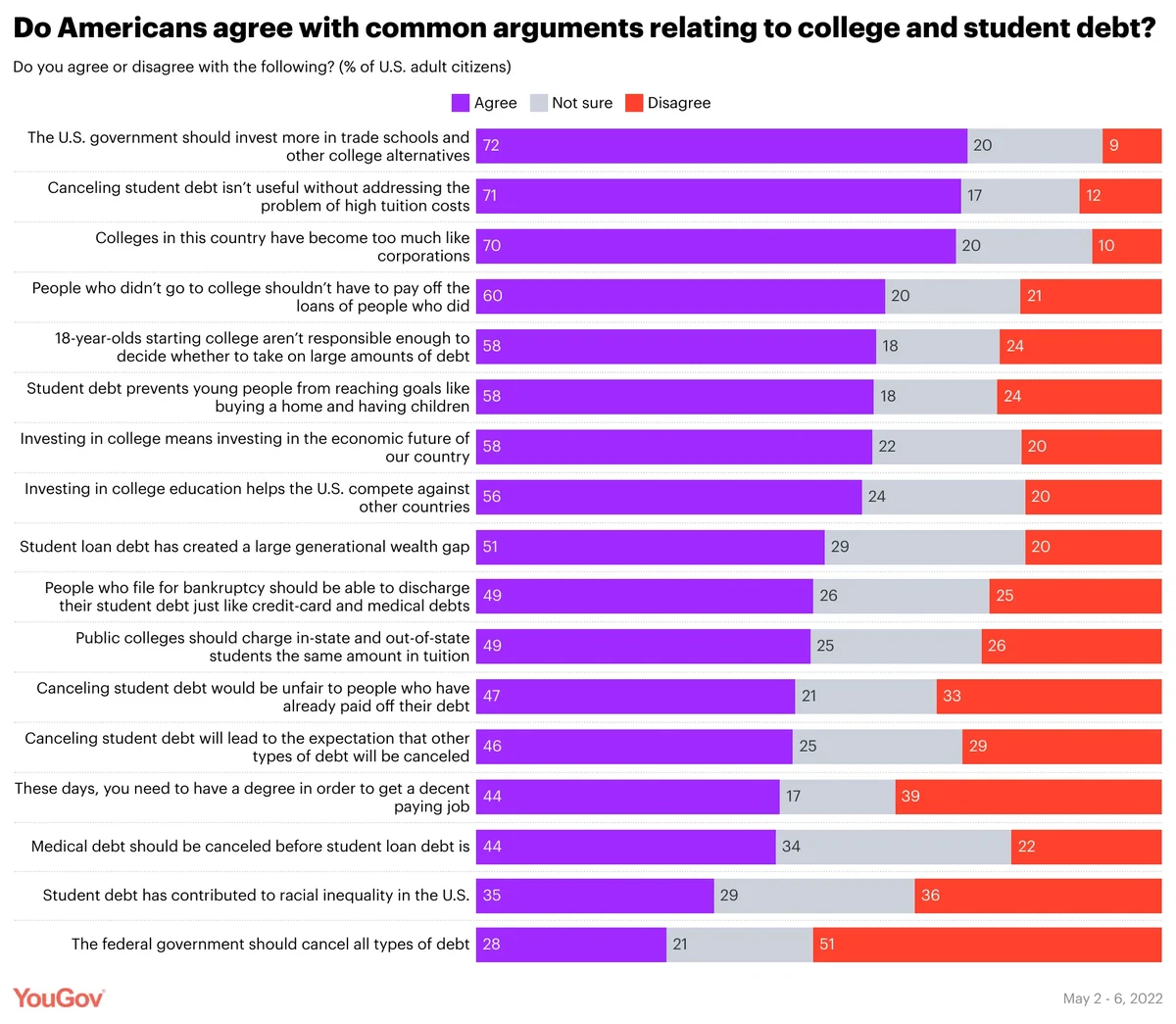

While most Americans support canceling at least some debt, many people also agree with arguments often cited in opposition to student-debt forgiveness. (While there are drawbacks to agree/disagree-style questions, they can be useful in comparing levels of support across different questions). For example:

- 71% agree and 12% disagree that canceling student debt isn't useful without addressing the problem of high tuition costs

- 60% agree and 21% disagree that people who didn't go to college shouldn't have to pay off the loans of people who did

- 47% agree and 33% disagree that canceling student debt would be unfair to people who have already paid off their debt

- 46% agree and 29% disagree that canceling student debt will lead to the expectation that other types of debt will be canceled

Americans are somewhat more likely to say the Democratic party is better at dealing with student debt and the price of college than the Republican party is, though one in four say neither party is good at handling this issue. Despite Democrats scoring higher than Republicans in this regard, Americans are more likely to disapprove (47%) than approve (33%) of how President Biden is handling the issue of student debt.

Biden’s approval rating on this issue may change if he enacts a plan similar to the one he has floated in recent months, which involves canceling around $10,000 in federal student-loan debt for each borrower who owes at least that much. A majority of Americans (55%) say they support this plan, while only 31% oppose it. However, many Americans are skeptical that Biden has the power to unilaterally forgive student debt – only 41% believe the president has the authority to widely cancel student loans, while 33% say the president does not.

Personal experiences with student debt

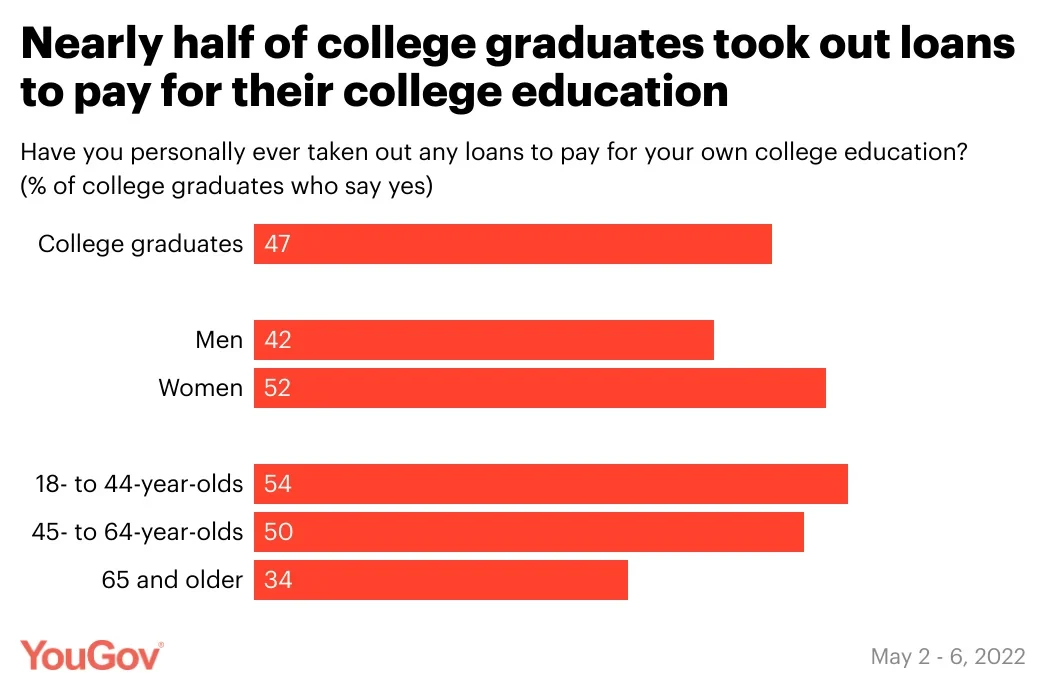

Almost half of Americans with a college degree (47%) say they took out loans to pay for their education. Women are more likely than men to have taken out loans, and Americans under 45 are more likely to have had loans than those older than 45. Most college graduates (60%) who took out loans say that when they graduated college they owed $25,000 or less, while a smaller share – 11% – say they owed $100,000 or more.

About half of Americans who took out student loans say they are still paying them off. The majority of Americans who still owe money toward their loans say they are very or somewhat worried about paying them off, and about one in three say they don’t think they’ll ever fully pay off their loans. Students aren’t the only ones with college debt. One in five parents – including over half of parents who took out loans to pay for their own education – say they have or plan to take out loans to pay for their children’s education.

One in five college graduates say they wouldn’t have gone to college if they knew what they know now, while 76% say they would still go. Similarly, one in five say they would’ve gone to a less expensive school if they knew what they know now, while 64% say they wouldn’t have.

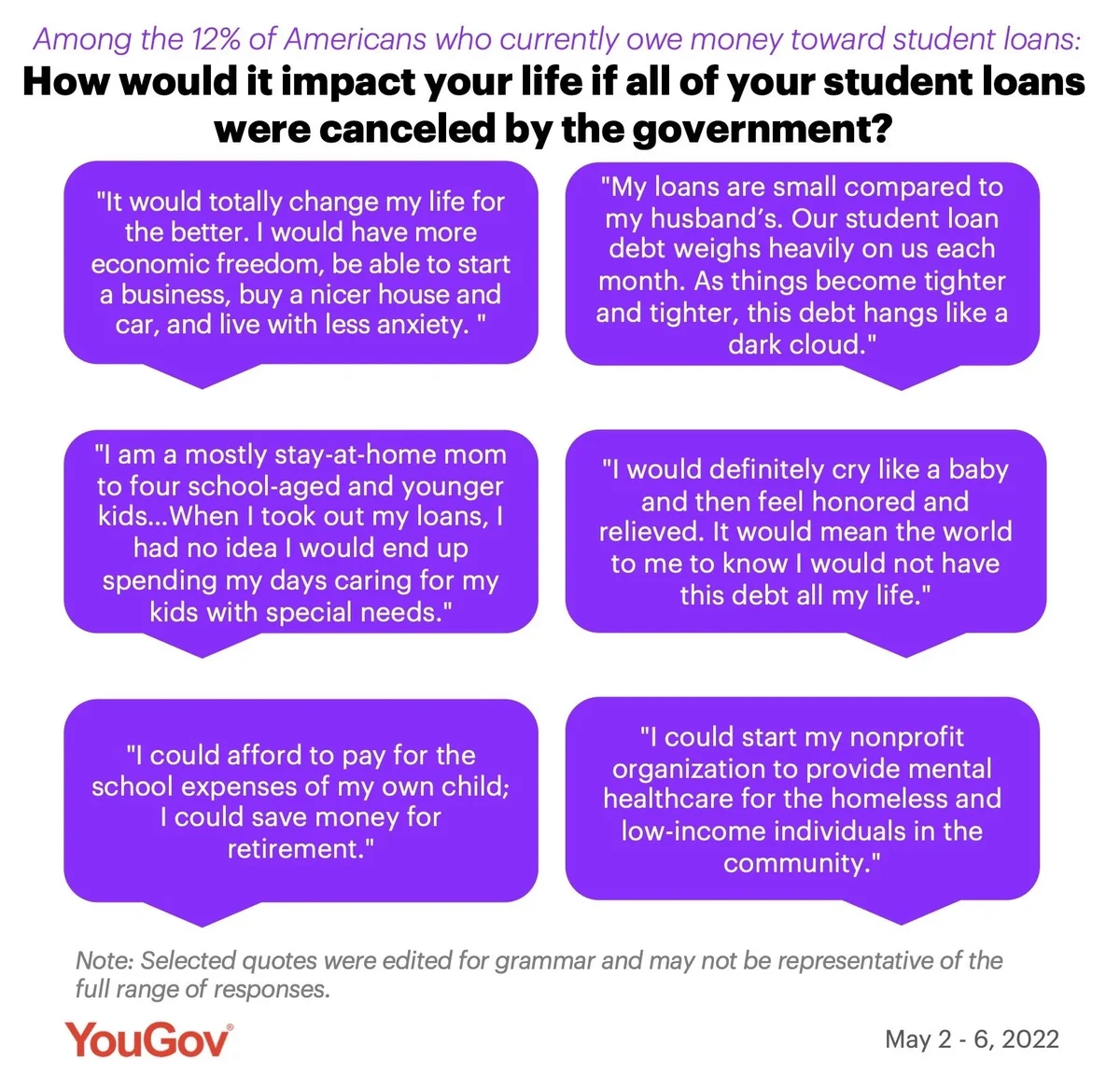

Our survey also asked people who currently hold student debt to tell us in their own words how debt forgiveness would impact their lives. Most people said it would have a positive effect on their lives, allowing them to save for other things like a house, a car, retirement, or their own children’s education. A number of people emphasized the detrimental impact that student debt has had on their credit scores, which has limited their ability to secure housing or other lines of credit. A few people say they believe debt cancellation would have no effect on them since they would end up paying more in taxes as a result.

— Carl Bialik contributed to this article

This poll was conducted on May 2 - 6, 2022, among 1,000 U.S. adult citizens. Explore more on the methodology and data for this poll.

Image: Ekrulila