New global research from YouGov shows what measures consumers take to keep their online activity private, some of which could hinder how brands connect with the consumer.

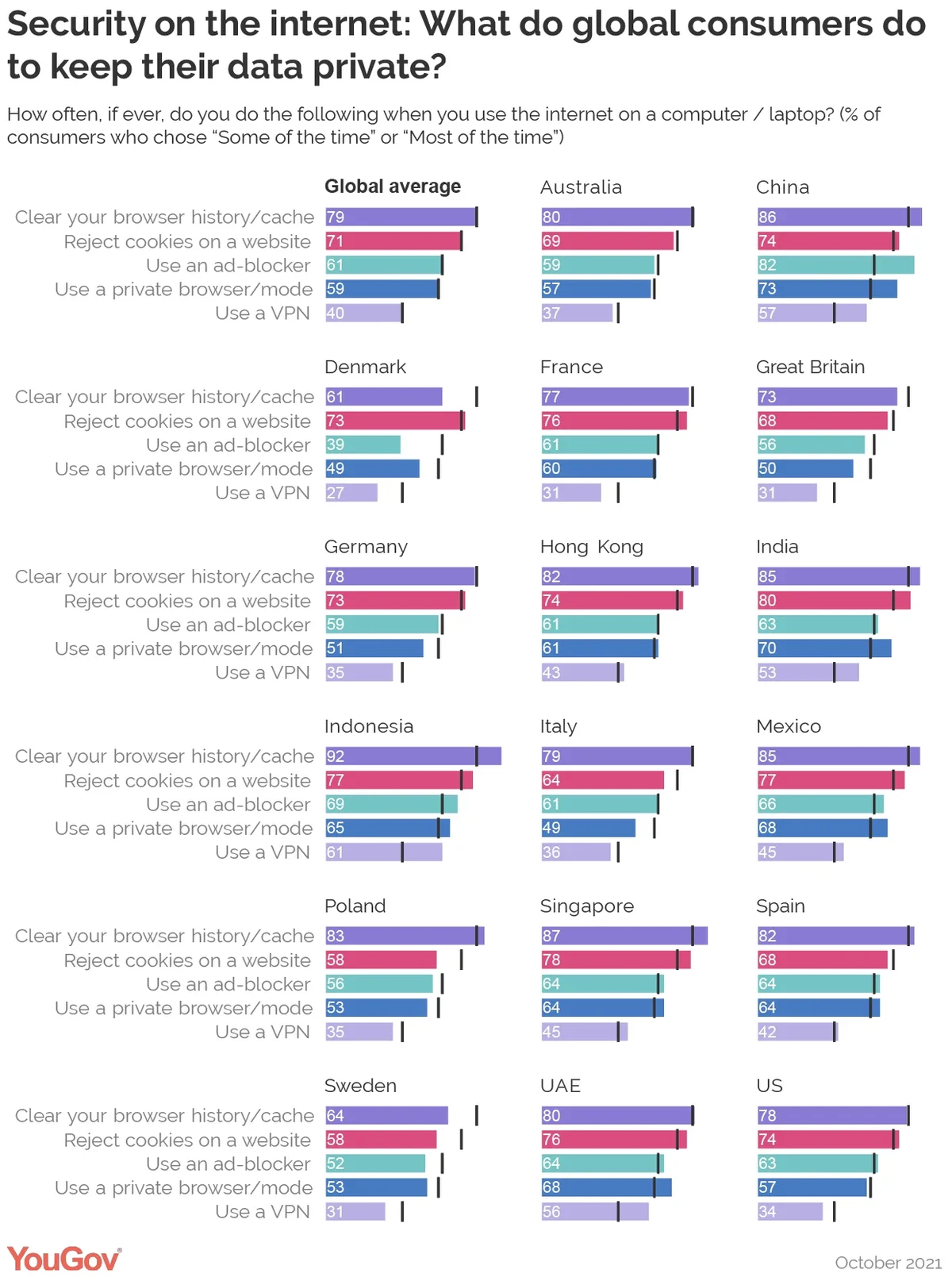

Of the steps presented to panelists in 17 global regions, clearing browser history is the most common measure taken, with 79% indicating as much. Consumers in Asian markets, such as China, Indonesia and India are particularly likely to clear their history.

A smaller but still significant proportion say they reject cookies on websites when online (71%). Online marketers have long relied on cookies to reach the right audience even as more browsers block tracking by default and laws are established ensuring users can accept or reject cookies.

About three out of five global consumers employ an ad-blocker when navigating online (61%), which presents obvious challenges for marketers. For years, these browser extensions have been in response to intrusive and clumsy ad campaigns that frustrate users. But efforts have been made in recent years to combat that problem, including initiatives like the Coalition for Better Ads.

Meanwhile, about the same proportion use a private browser/mode (59%), again with consumers in Asian markets such China, India, and Indonesia more likely to go incognito.

Consumers are least likely to make use of a virtual private network (VPN) to protect their privacy online (40%). Again, consumers in Asian markets are more likely to take this step.

Behaviors in the United States are very much in line with the global average, while those in Great Britain are slightly less likely to take any of these measures.

Receive monthly topical insights about the tech industry, straight to your inbox. Sign up today.

Discover more tech content here

Start building a survey now with YouGov Direct

Methodology: The data is based on the interviews of adults aged 18 and over in 17 markets with sample sizes varying between 513 and 2,020 for each market. All interviews were conducted online in October 2021. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.